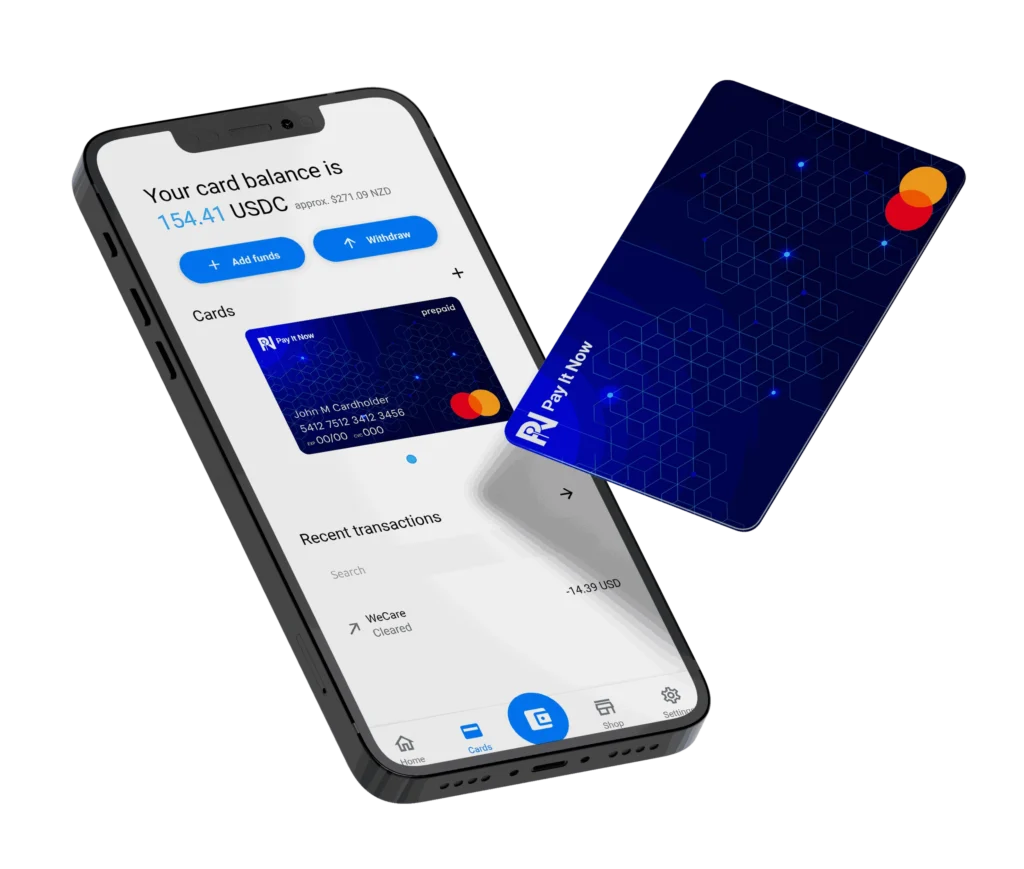

What Is a Web3 Credit Card? A New Way to Spend in the Crypto Era

Let’s start with the basics: a Web3 credit card is a payment card (yeah, like Visa or Mastercard) that connects with your crypto wallet and taps into decentralized finance—aka DeFi. It lets you spend crypto like cash. Sounds futuristic? That’s because it kind of is. But this isn’t some far-off fantasy—these cards exist, and they’re already reshaping how people interact with money.

So, what makes it Web3? It’s all about decentralization. Unlike traditional cards tied to centralized banks, a Web3 credit card is often linked to decentralized apps (dApps), smart contracts, and sometimes, even a DAO (decentralized autonomous organization). Think of it as your regular credit card’s cooler, more independent cousin who doesn’t answer to the big banks.

How Does It Work?

Okay, so how does this actually work in the real world? Good question.

Most Web3 credit cards work like a hybrid. You’ve got one foot in the traditional finance world (like the ability to swipe or tap at a store), and the other in the crypto universe (holding assets like ETH or USDC). These cards either:

- Draw directly from your crypto wallet

- Convert crypto to fiat in real-time

- Offer credit based on crypto holdings (yep, your Bitcoin might just be your credit score)

Some of them work with stablecoins, while others let you stake tokens or earn rewards in crypto rather than airline miles or cashback. Not a bad trade, huh?

You’ll usually need to connect a Web3 wallet (MetaMask, Trust Wallet, etc.) and verify your identity—so yes, there’s still some of that old-school compliance stuff involved.

Why Use It?

Now, here’s the million-dollar (or maybe 1 ETH) question—why bother?

For starters, you get to actually use your crypto. A lot of people hold onto tokens like digital gold. A Web3 credit card gives them a way to spend that value without waiting for moon-level prices.

Then there’s the privacy and control factor. Some Web3 cards are built to protect your data better than traditional cards, thanks to blockchain’s transparency and immutability. Others give users control over how much credit they access or how rewards are earned—customization you won’t find with Chase or Amex.

Plus, crypto-native perks are starting to show up: NFT rewards, gas fee discounts, even staking bonuses. It’s not just “spend and forget”—it’s spend and grow.

Web3 Credit Card vs. Traditional Credit Cards

Here’s a little side-by-side to help things click:

| Feature | Traditional Credit Card | Web3 Credit Card |

|---|---|---|

| Linked to bank account | yes | no (crypto wallet instead) |

| Offers cashback/miles | yes | yes (but in crypto) |

| Decentralized | no | yes |

| Crypto-based credit | no | yes |

| Rewards in NFTs/tokens | no | yes |

| Credit score needed | yes | sometimes |

But let’s be honest—Web3 credit cards aren’t perfect. They’re still pretty new, and adoption is limited. You might run into weird fees or tech hiccups. And depending on the provider, your crypto might need to be locked up as collateral.

Still, the potential? Pretty exciting.

Are Web3 Credit Card the Future of Finance?

Maybe. It’s a big maybe—but a hopeful one.

Web3 credit cards represent a shift away from centralized control toward user-owned financial ecosystems. That’s not just marketing fluff; it’s a fundamental change in how money can move.

If adoption keeps rising—and that’s a big if—we might see more people ditching traditional banks in favor of crypto-powered tools. But we’re still early. There are regulatory hurdles, UX improvements to be made, and, frankly, a lot of people who just want to tap their phone and move on with their day.

That said, the Web3 credit card is more than a buzzword. It’s a real, functional tool that gives crypto actual spending power. And who knows? A few years from now, using one might be as normal as Venmo.

Until then—keep your wallet ready. Both kinds.

Relevent news: Here