In Indonesia, “forex” means more than one thing. On one end, you have online forex trading platforms, where users speculate on currency values through digital tools. On the other, you have physical money changers that provide foreign currency for travel or business needs. Both fall under the broader umbrella of Forex Indonesia, yet they serve very different purposes and people. Understanding how these services work — and when to use which — can help you make better financial decisions and avoid confusion.

Forex Indonesia: What Is Forex Trading and What Makes It Unique?

Forex trading is a digital financial activity where you buy one currency and sell another, hoping to profit from price movements. This kind of trading happens on platforms and apps offered by forex brokers — not in person. In a typical trade, you might exchange Indonesian rupiah for US dollars, and then sell them later at a higher rate. The difference is your potential profit — or loss.

To trade forex legally in Indonesia, you must use a broker licensed by BAPPEBTI, the government agency that regulates futures and forex trading. These brokers offer tools to track charts, set risk levels, and analyze trends. The trading market is open 24 hours a day from Monday to Friday, aligning with global market hours. Forex trading is popular among people with financial goals beyond saving — including those seeking diversification or high-risk/high-reward opportunities. But it’s not for everyone; it requires both market awareness and emotional discipline.

Forex Indonesia: What Does a Money Changer Offer?

Source: The Conversation

A money changer is a physical outlet that allows customers to convert one currency into another. These services are common in Indonesian shopping centers, airports, and financial districts. If you’re going overseas and need cash in a foreign currency, this is the most straightforward way to get it. You hand over your rupiah, check the posted exchange rate, and receive cash in the required currency.

Money changers in Indonesia are regulated by Bank Indonesia, which ensures they operate fairly and transparently. You don’t need an app, trading account, or market knowledge — just an ID and cash. The experience is immediate, predictable, and grounded in daily financial life. In the context of Forex Indonesia, money changers represent convenience and real-world utility, particularly for travelers, business owners, and overseas families.

Core Differences: Forex Indonesia- Function, Format, and Purpose

Source: Adaremit

At first glance, both services seem related — after all, they involve exchanging currency. But once you look closer, the differences become obvious. Forex trading is an investment strategy done digitally. Users hope to profit from price changes rather than obtaining physical money. This process is data-driven and relies on live pricing, economic news, and trading discipline.

Money changers, on the other hand, serve immediate real-world needs. You exchange actual banknotes and receive cash in return — no speculation involved. The customer’s goal isn’t to profit from future rates, but to get usable currency on the spot. One works like a stock exchange; the other works like a counter service.

These roles coexist within the Forex Indonesia environment, catering to very different financial behaviors.

When to Use a Money Changer

Source: todayonline

If your goal is to travel, send money abroad, or pay for expenses in a foreign country, a money changer is your best option. It offers instant, physical cash and doesn’t require any special skills or setup. You simply find a licensed outlet, review the posted exchange rate, and complete your transaction.

This option is perfect for people who prefer face-to-face transactions, need immediate results, or don’t want to deal with digital platforms. Whether you’re a student leaving for Australia or a parent sending cash to a child overseas, the simplicity and clarity of a money changer make it the logical choice.

When to Consider Forex Trading

Source: Antara News

Forex trading is better suited for those with a strong interest in financial markets and the time to monitor exchange rate trends. It’s an option worth exploring if you want to build an active investment habit or learn about global economic behavior. However, success in forex trading doesn’t come overnight. It requires strategy, patience, and a strong understanding of risk.

Indonesian traders are encouraged to begin with demo accounts or small amounts. Reputable trading platforms — those licensed by BAPPEBTI — also offer educational materials, webinars, and customer support. As long as you approach it with caution and discipline, forex trading can be a valid part of a well-rounded financial strategy within Forex Indonesia.

How Exchange Rates Work in Both Models

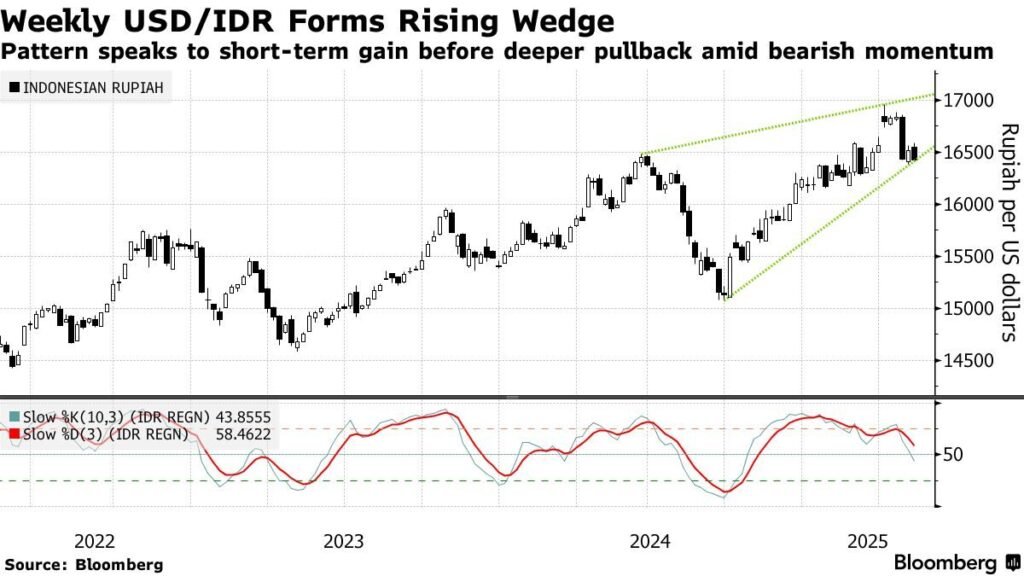

Source: Bloomberg

Exchange rates differ between trading platforms and money changers — and for good reason. Money changers set their rates daily, adding a small margin to cover operational costs and profit. This rate can vary depending on the location, the demand for a certain currency, and how much you’re exchanging.

Forex platforms, on the other hand, use live interbank rates that update in real time. These prices are often closer to actual market levels. However, traders may still pay through spreads (the difference between buy and sell prices) or commissions. Traders benefit from accuracy and flexibility, while money changer customers benefit from speed and simplicity. Each pricing model fits the purpose of its service in the broader Forex Indonesia system.

How to Stay Safe and Legal

Source: Banksinarmas

Safety starts with choosing the right provider. In Indonesia, all legal forex brokers must be licensed by BAPPEBTI. This guarantees they follow national regulations, offer secure trading environments, and protect customer funds. Before using any app or website, check the broker’s status on BAPPEBTI’s official portal.

For money changers, always choose businesses registered with Bank Indonesia. Licensed outlets will have clear signage, printed receipts, and proper exchange rate displays. Avoid dealing with street vendors or online exchange offers without regulation — even if the rates seem attractive. Staying within the rules protects not just your money, but your data and financial identity.

Conclusion: Which Path Is Right for You?

In the diverse world of Forex Indonesia, both forex trading and money changers have valid roles. If you need foreign currency for immediate, personal use — such as travel or education — the money changer is the right choice. It’s simple, fast, and rooted in everyday transactions. If you’re looking to participate in financial markets and are willing to invest time and thought, forex trading might suit your goals — provided you stay cautious and informed.

By understanding how each option works, Indonesians can confidently navigate the foreign exchange space — using the right tools for the right moment.