Day Trading Indonesia: In Indonesia’s growing online trading scene, day trading is increasingly visible among both forex and stock traders. It’s a method defined by speed — buying and selling within the same day, sometimes in just a matter of minutes. Day trading Indonesia-style often happens during overlapping international trading hours, especially in forex markets where volatility is high. This approach appeals to traders who enjoy fast decision-making and staying closely tuned in to price movements, but it also demands time, focus, and a strong grasp of risk.

Day Trading Indonesia: Why Swing Trading Fits a Different Kind of Lifestyle

For those who can’t sit in front of charts all day, swing trading presents a compelling alternative. Instead of chasing every tick, swing traders aim to catch broader market moves, holding positions for several days or even weeks. In the Indonesian context, this suits people with full-time jobs, students, or anyone balancing multiple responsibilities. You still need solid technical skills, but the pace is slower — analysis happens after hours, often using daily or 4-hour charts, making it far more accessible for those with tight schedules.

Day Trading Indonesia: Can You Realistically Dedicate Hours to Trading Daily?

Source: iStock

Your available time may be the biggest clue in choosing between these strategies. Day trading isn’t just about fast execution — it’s about watching the market actively for hours at a time. If you’re based in Indonesia and trading forex, that might mean being online during evening sessions. Swing trading, however, is more forgiving. You might only need to check the charts twice a day — once before markets open and once after they close. It’s not passive, but it does allow more freedom to step back and live your life.

Emotional Management: Day Trading Indonesia- A Key Difference in Trading Styles

Source: AsiaTimes

One of the less discussed but critical differences between day and swing trading lies in emotional control. Day trading can be stressful. The markets move quickly, and the pressure to make instant decisions can lead to emotional fatigue. Some traders thrive under that pressure; others struggle. Swing trading allows more breathing room. You can take time to reflect, avoid knee-jerk reactions, and stay emotionally neutral — something many Indonesian traders appreciate, especially when juggling outside commitments or dealing with market noise.

Comparing Risks, Rewards, and the Nature of Profit

Indonesian day traders often aim for smaller profits per trade, relying on volume to build returns. That can add up — but so can the losses, especially if risk isn’t tightly managed. With swing trading, each position generally targets a higher profit but takes longer to develop. Your capital is tied up longer, but your stop-losses may be wider, and your reward-to-risk ratio can be more favorable. Both methods carry risk — what changes is how fast the outcomes arrive and how much control you have over each move.

Is Forex Better Suited for Day Trading or Swing Trading?

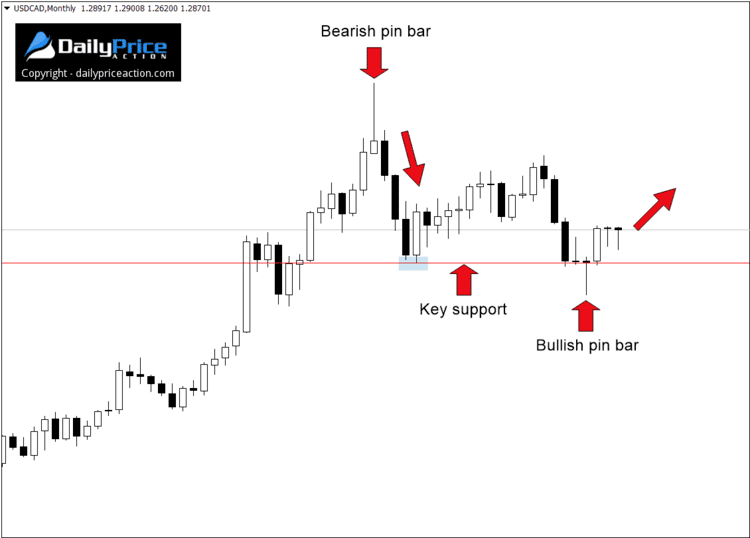

Source: Daily Price Action

Forex remains a dominant space for Indonesian traders, and it supports both styles well. Day traders often prefer forex for its liquidity and predictable volatility patterns during major sessions like London or New York. They can enter and exit trades quickly with tight spreads. Swing traders, on the other hand, use longer timeframes like the 4-hour or daily charts to identify trends and reversals. Whether you focus on EUR/USD or cross pairs tied to the Indonesian Rupiah, you can tailor your trading strategy to your preferred tempo.

Personal Traits That Influence Strategy Selection

More than charts and indicators, your personality often determines which trading style fits best. If you enjoy fast feedback, action, and problem-solving under pressure, you may lean toward day trading. If you value patience, structured analysis, and clear planning, swing trading could be the better choice. Many Indonesian traders who start out wanting excitement later realize that consistency comes from knowing their own preferences and habits — not just from copying strategies seen on social media or in forums.

Testing Both Styles Before Committing

Before fully committing to either path, Indonesian traders can take advantage of demo accounts or low-volume real trades. Try one week of active day trading during peak forex sessions, and then try a week of swing trading using longer-term setups. Evaluate not just your profits and losses, but how you feel during the process. Did you enjoy it? Were you exhausted or focused? What worked better with your daily routine? This practical experimentation can lead to clarity that theoretical comparisons often can’t provide.

The Long-Term View for Indonesian Traders

As your skills grow, your trading style might evolve too. Some traders in Indonesia start with the thrill of day trading Indonesia and later shift to swing trading for sustainability. Others combine both — using swing trades for core positions and adding occasional intraday setups when time allows. The key isn’t just choosing what’s trending, but understanding what’s realistic and rewarding for you over time. Whether fast-paced or more measured, the trading style that fits you best is the one that supports your goals and lifestyle in the long run.