In the evolving world of online forex trading, one concept keeps appearing in conversations among investors: Prorex Pamm Trader. This model, part of Prorex Limited’s broader portfolio management system, offers a way for both beginners and experienced traders to take part in markets without managing every position themselves. But what exactly is it, and how does it work in practice?

Understanding the Prorex Pamm Trader Model

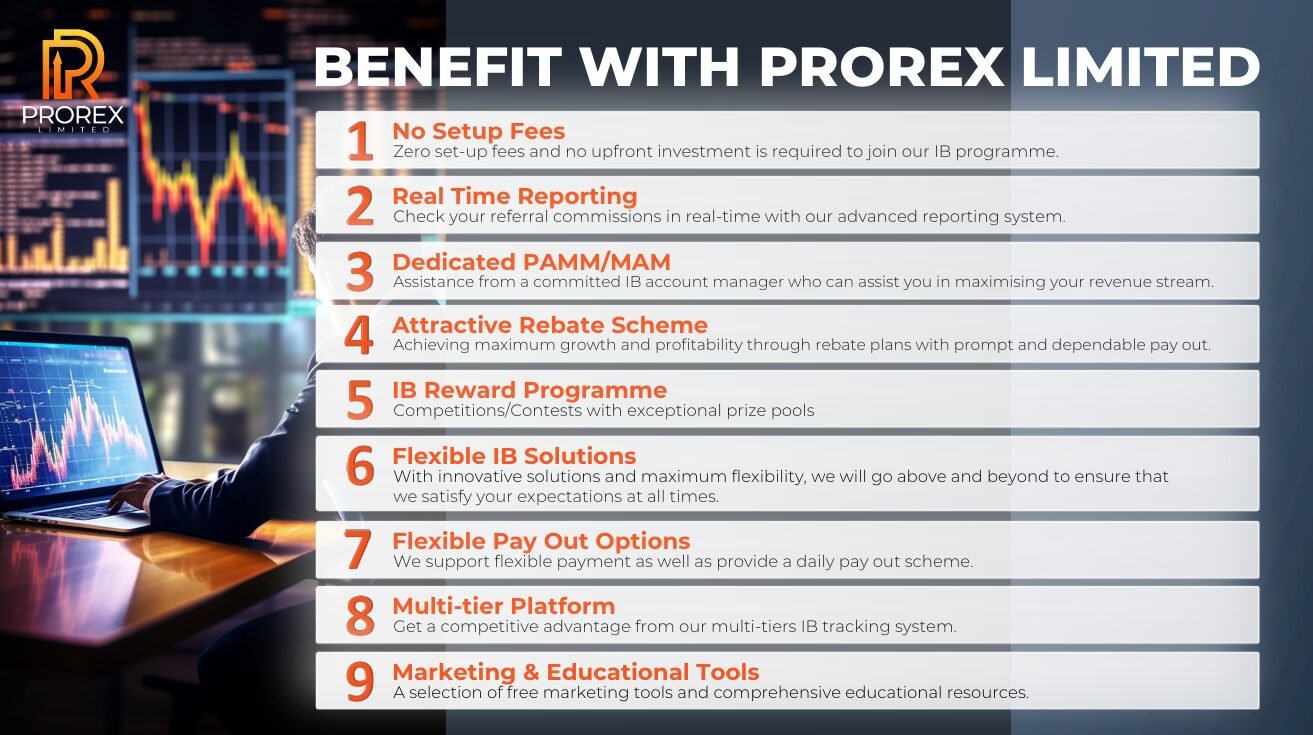

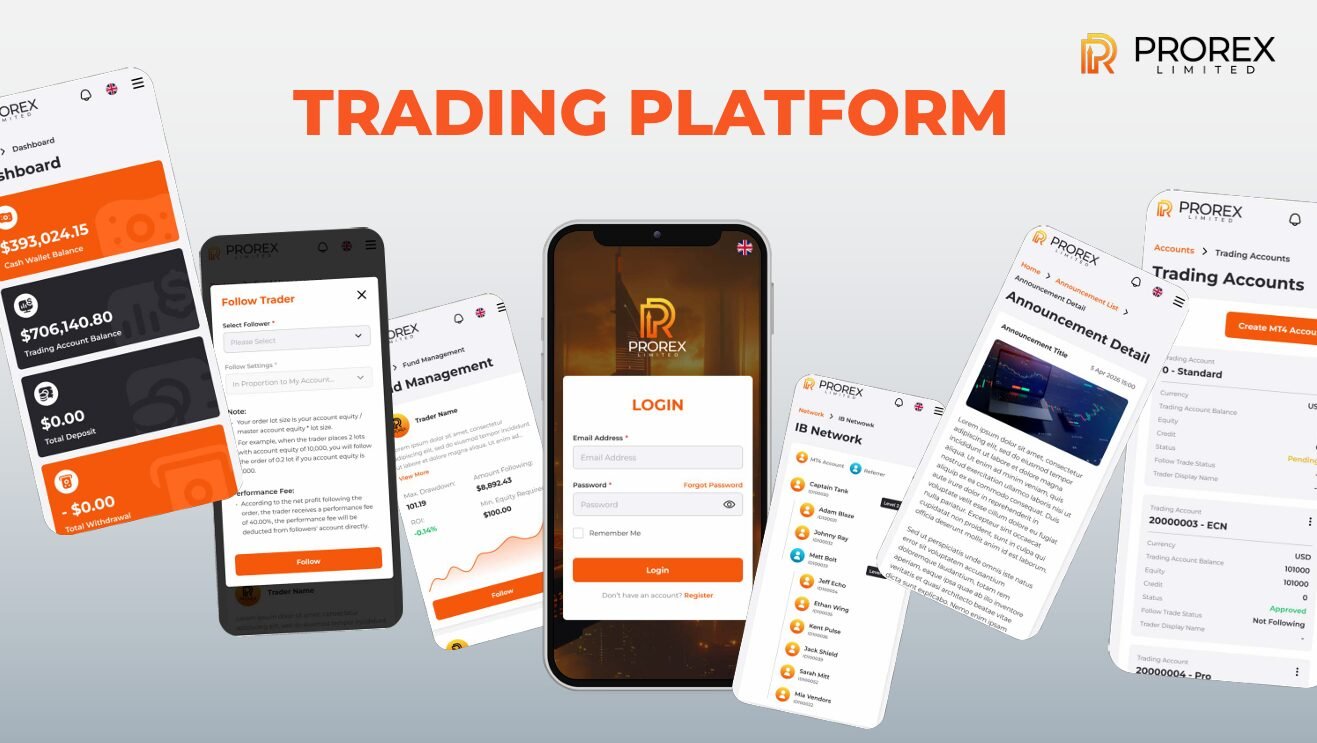

At its core, a PAMM account—short for Percentage Allocation Management Module—is a system that allows multiple investors to allocate their funds to a professional trader, who then manages trades on their behalf. Prorex Pamm Trader integrates this structure within its licensed brokerage framework in Mauritius, offering customizable allocation methods, real-time reporting, and compatibility with the MetaTrader 5 platform.

Unlike traditional self-directed trading, PAMM accounts reduce the need for constant market monitoring. Investors can review strategy providers, assess past performance, and decide how much to allocate. Prorex’s version emphasizes transparency—performance fees, management fees, or even subscription fees can be set upfront, making the conditions clear before investing.

Prorex Pamm Trader vs. Copy Trading

It’s easy to confuse prorex pamm trader with copy trading, since both involve following experienced traders. The difference lies in structure. Copy trading allows followers to replicate trades one-to-one in real time, while a PAMM account pools investor funds into a single managed account, distributed proportionally.

Prorex Limited hosts both systems on its platform. A user may choose copy trading for direct mirroring of strategies or opt for the PAMM model when seeking more structured management. In either case, tools like real-time reporting, expert advisor (EA) support, and ultra-low spreads help streamline the process.

Risks and Benefits of PAMM Investing

As with any investment, PAMM trading carries both opportunities and challenges. The benefits include access to experienced fund managers, portfolio diversification, and potential passive income without the need for day-to-day trading decisions. For those who may not have the time or expertise, it can be an entry point into forex and CFD markets.

The risks, however, should not be overlooked. Performance depends heavily on the skill of the chosen manager, market volatility, and fee structures. Unlike guaranteed products, a PAMM account reflects real market outcomes—profits and losses alike. That’s why platforms like Prorex emphasize investor education, transparent reporting, and the ability to review multiple strategy providers before committing funds.

Conclusion: Where Prorex Pamm Trader Fits in 2025

The landscape of forex brokers has grown increasingly competitive, with many offering copy trading, MAM, and PAMM services. Prorex Limited positions itself within this field by combining licensed operations, MT5 compatibility, and flexible portfolio management modules.

For investors curious about prorex pamm trader, the model represents both a technological tool and an investment approach—bridging the gap between self-trading and full fund management. In 2025, it remains a relevant option for those seeking structured, yet flexible, exposure to global markets.

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia