The Changing Face of Online Trading

The forex industry has always moved quickly, but in recent years the rhythm feels even faster. More traders are entering global markets, and with them comes a new set of expectations: transparency, choice, and flexibility. PROREX is one of the platforms that has surfaced in this conversation, particularly in Asia, where both individual investors and fund managers are exploring different ways to manage capital.

PROREX and the Structure of Trading Accounts

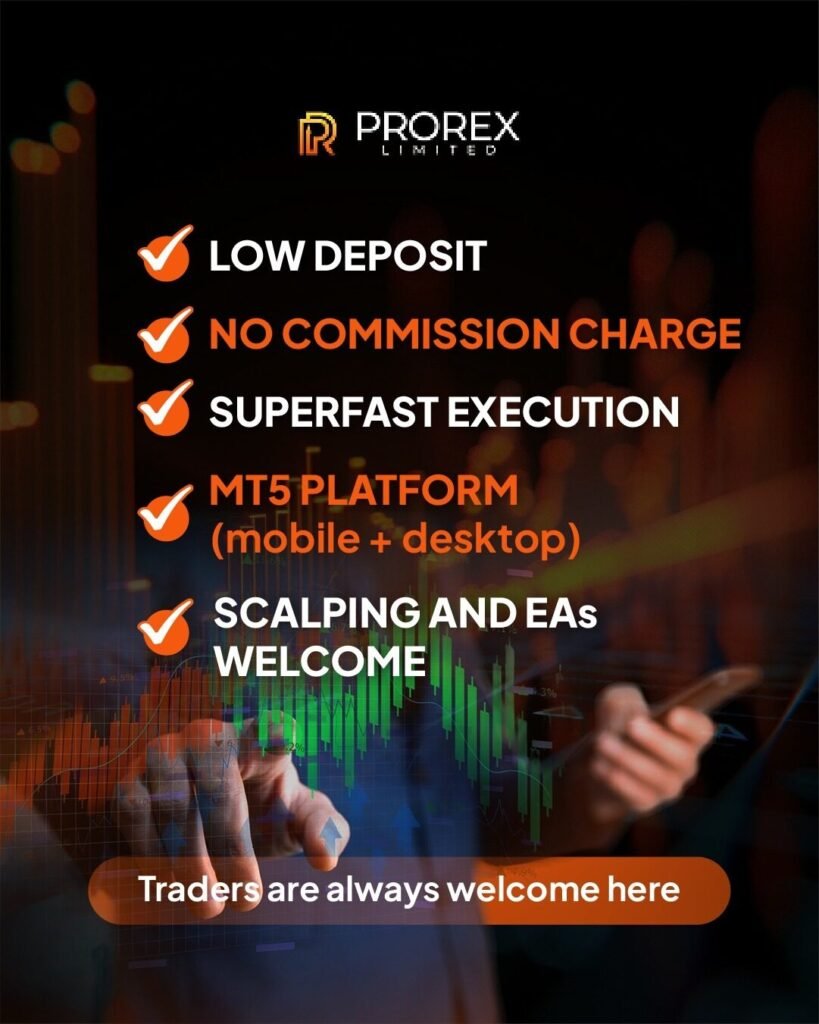

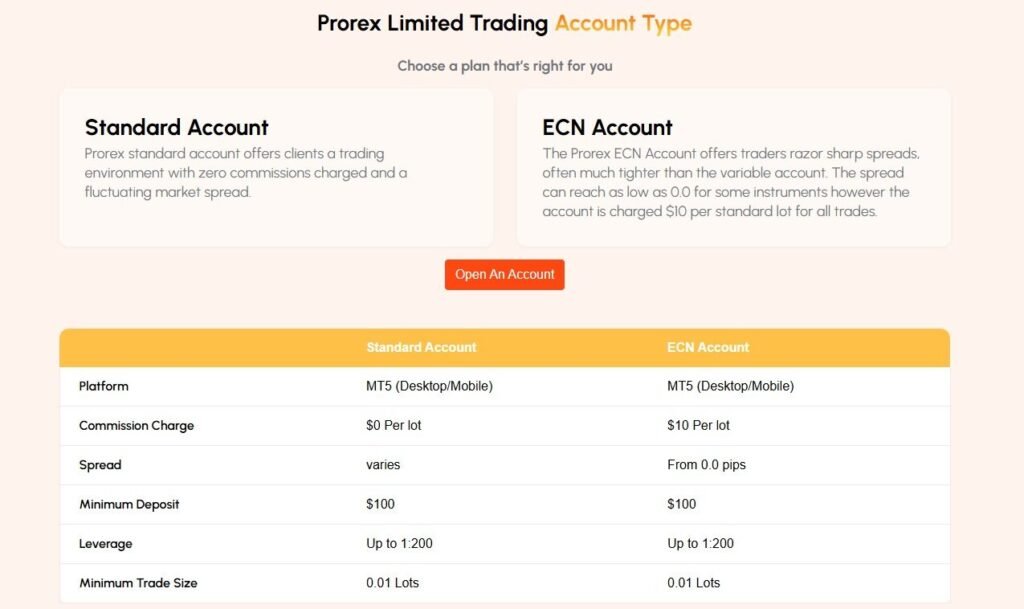

One of the first things new traders notice is that PROREX offers two distinct account types: a Standard Account and an ECN Account. Standard accounts tend to attract beginners because there are no commissions attached, though the spreads fluctuate with market conditions. ECN accounts, on the other hand, are designed with tighter spreads — in some cases close to zero — but charge a flat commission per lot.

This type of division isn’t unique to PROREX, but it does highlight a broader trend: platforms are trying to cater to both casual traders and more experienced professionals. For a university student placing small trades, the Standard option might feel less intimidating. For a scalper running algorithms, the ECN structure makes more sense.

PAMM, Copy Trading, and the Shift Toward Collective Strategies

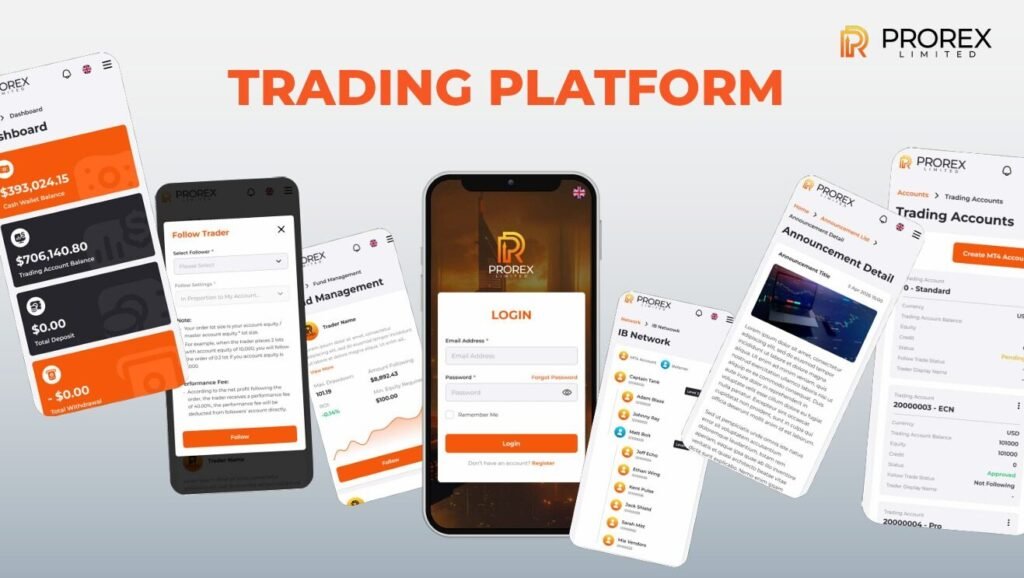

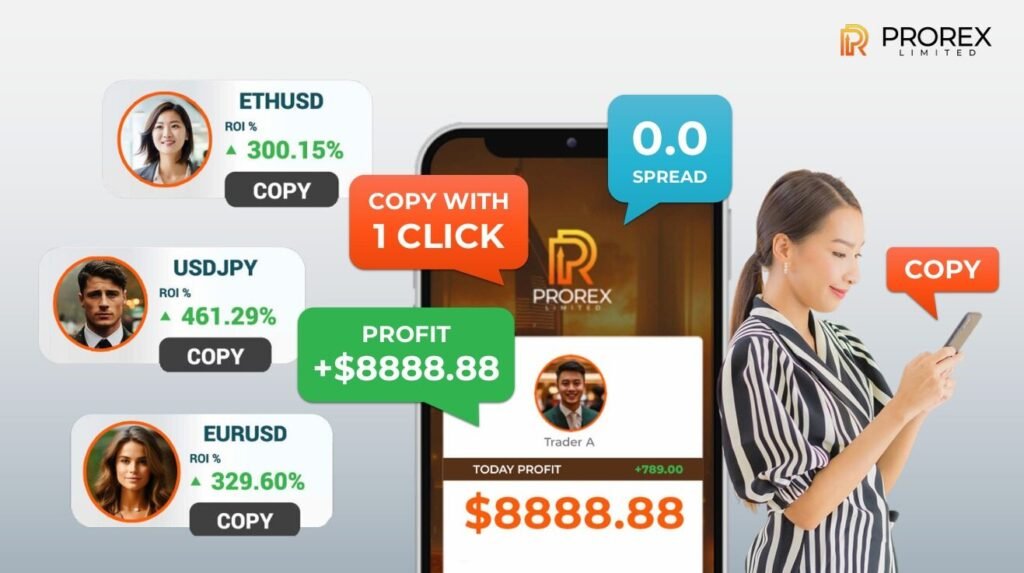

Another area where PROREX surfaces in market discussions is its PAMM trader model. PAMM (Percentage Allocation Management Module) accounts allow investors to allocate funds to experienced traders, who then manage multiple accounts simultaneously. The system calculates performance and distributes profits or losses proportionally.

It’s not a new invention, but its increasing popularity shows how copy trading and portfolio management are becoming mainstream. For individuals without the time or confidence to make every trade, PAMM structures — whether on Prorex Asia or other brokers — provide a bridge into markets without constant screen-watching.

There’s also growing curiosity around Prorex copy trading and even discussions of Prorex AI trading. Automation is part of the modern trading narrative, and many traders are experimenting with AI-assisted strategies or indicators. The catch, as always, is balancing innovation with risk management.

Prohibited Practices and the Reality of Rules

Trading platforms also carry rules that some newcomers may overlook. Prorex product guidelines are clear on what counts as prohibited trading: arbitrage between accounts, high-frequency bursts where trades are opened and closed within minutes, and exploiting negative balance protection during volatile news releases.

These restrictions may seem technical, but they underline a simple truth — trading isn’t just about spotting opportunity, it’s about staying within the framework of fair play. That’s where human discipline comes in, something no AI trading bot can fully replace.

Low Spreads, Slippage, and the Everyday Experience

For many retail traders, the real daily concern is not abstract strategies but execution. Market slippage — when an order is filled at a different price than expected — is a common experience. PROREX, like many brokers, uses market execution, meaning orders are filled at the best available price rather than a guaranteed entry.

This might sound like a technical footnote, yet it can shape someone’s trading story. A well-timed order that slips by a few pips might turn a winning day into a flat one. It’s these small, human moments that make the trading journey both frustrating and fascinating.

PROREX Bonuses, Revenue Share, and Regional Campaigns

Another topic that often draws attention is the Prorex free credit or Prorex free bonus promotions. For example, limited campaigns in certain markets offer trial credit with conditions such as minimum lot requirements or restrictions on hedging. While these incentives can look attractive, seasoned traders tend to see them as practice tools rather than long-term profit sources.

There’s also mention of a Prorex Revenue Share Program, reflecting a broader industry model where introducing brokers or affiliates earn by bringing new traders on board. Again, it’s not unique to PROREX but part of the way the ecosystem sustains itself.

PROREX Looking Ahead

Trading platforms are not static; they adapt as markets and technology shift. From Prorex indicators to copy trading setups, the conversation around forex today is about finding balance — between risk and reward, independence and collective strategy, speed and patience.

For those watching the industry, PROREX is less a singular solution and more a case study in how traders interact with structure, strategy, and regulation. Whether it’s through a PAMM account, an ECN spread, or a simple standard trade, the choices reflect the diversity of modern investing styles.

📌 Conclusion

As the forex industry continues to evolve, PROREX provide an example of how trading tools, account structures, and community models. They are reshaping the way individuals approach the market. From low spread execution to PAMM trader options, the story isn’t about one product alone but about the broader ecosystem of opportunity and caution that defines online trading today.

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia