In recent years, the conversation around managed accounts has grown louder. More traders and investors are looking at PAMM investment platforms as a way to balance personal decision-making with professional management. Among the names that surface in this space is Prorex PAMM, a system designed to simplify allocation between traders and investors.

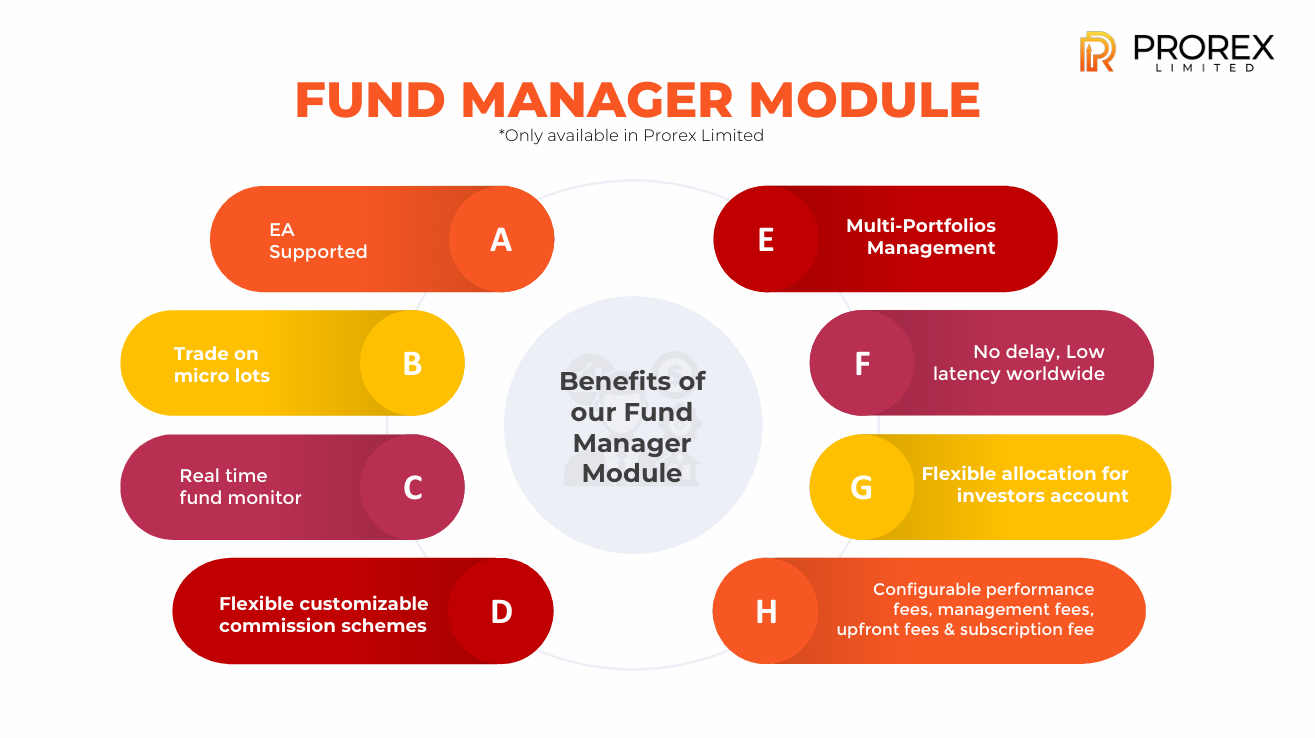

At its core, PAMM—short for Percentage Allocation Management Module—allows individuals to allocate funds to a professional trader while maintaining transparency. The Prorex PAMM system is integrated into its fund manager module, alongside a multi-account manager (MAM) option, offering flexibility for both individual investors and fund managers.

How Prorex PAMM Works in Practice

Unlike traditional investment vehicles, Prorex PAMM trading is tied to the execution of trades in real-time. Investors can connect their accounts, set a preferred allocation, and monitor results without manually entering every trade. This system supports prorex pamm traders who manage strategies, as well as investors who seek diversification.

The features include:

- Real-time reporting of performance and commissions.

- Flexible performance fee structures and customizable allocations.

- Compatibility with Expert Advisors (EA), enabling Prorex AI trading strategies.

In addition, investors benefit from prorex low spread conditions, while fund managers can configure multiple portfolios and publish strategies with relatively low minimum deposits. This creates an ecosystem where transparency and choice define the investor’s journey.

Beyond PAMM: Copy Trading and Revenue Sharing

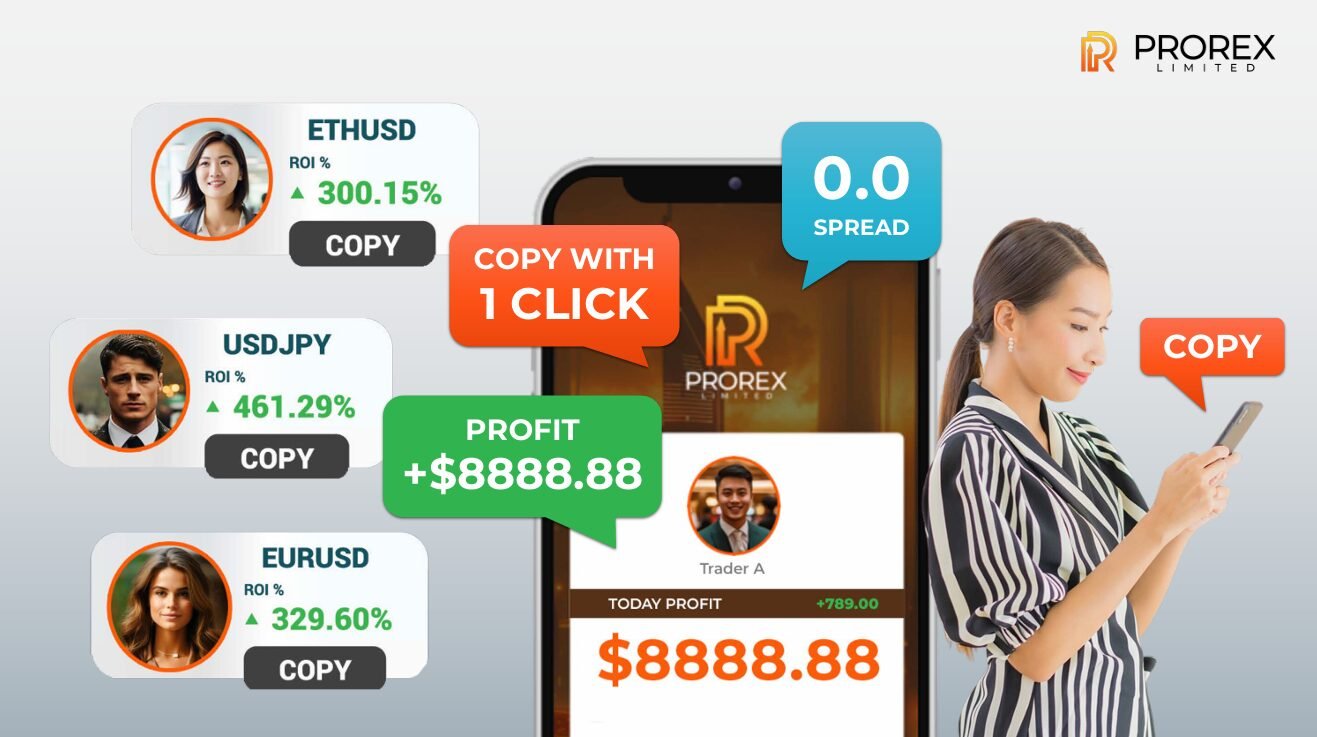

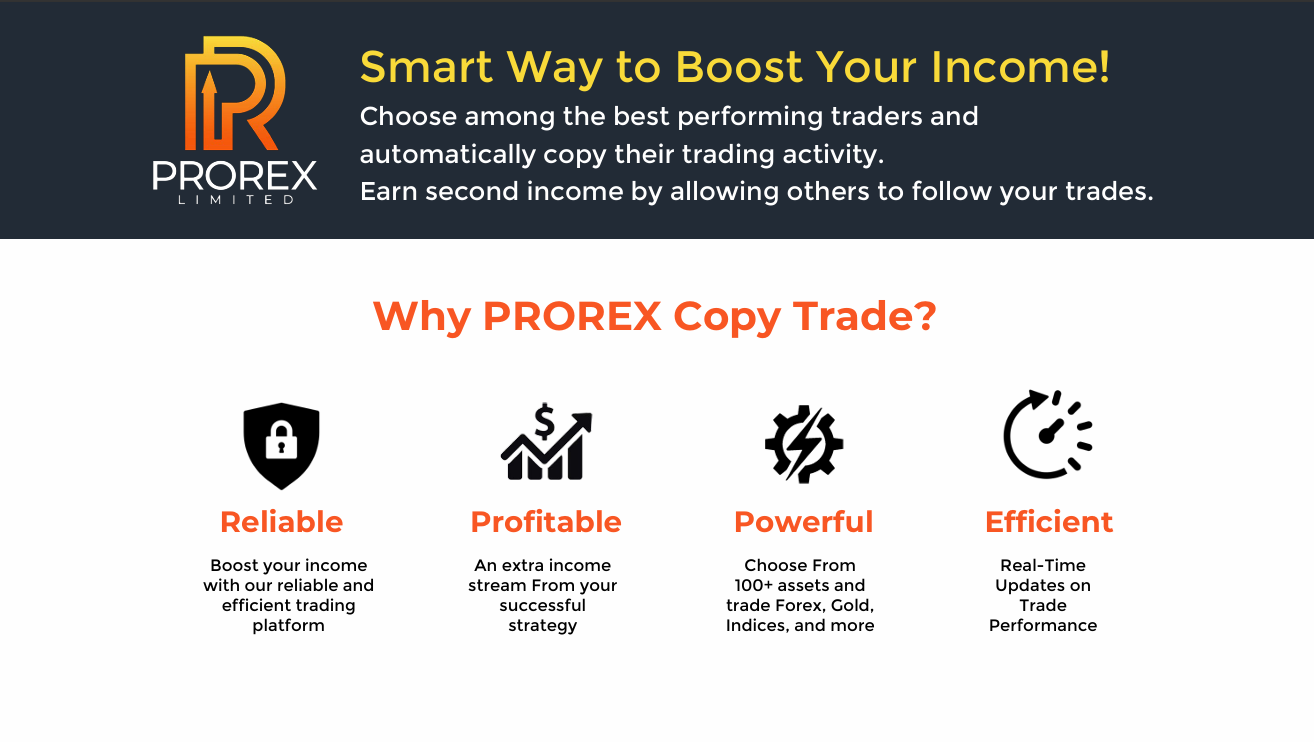

While PAMM accounts remain a highlight, Prorex also integrates copy trading platforms that allow users to mirror the moves of experienced traders in just a few clicks. This Prorex copy trading feature complements the PAMM system by catering to users who prefer less hands-on engagement.

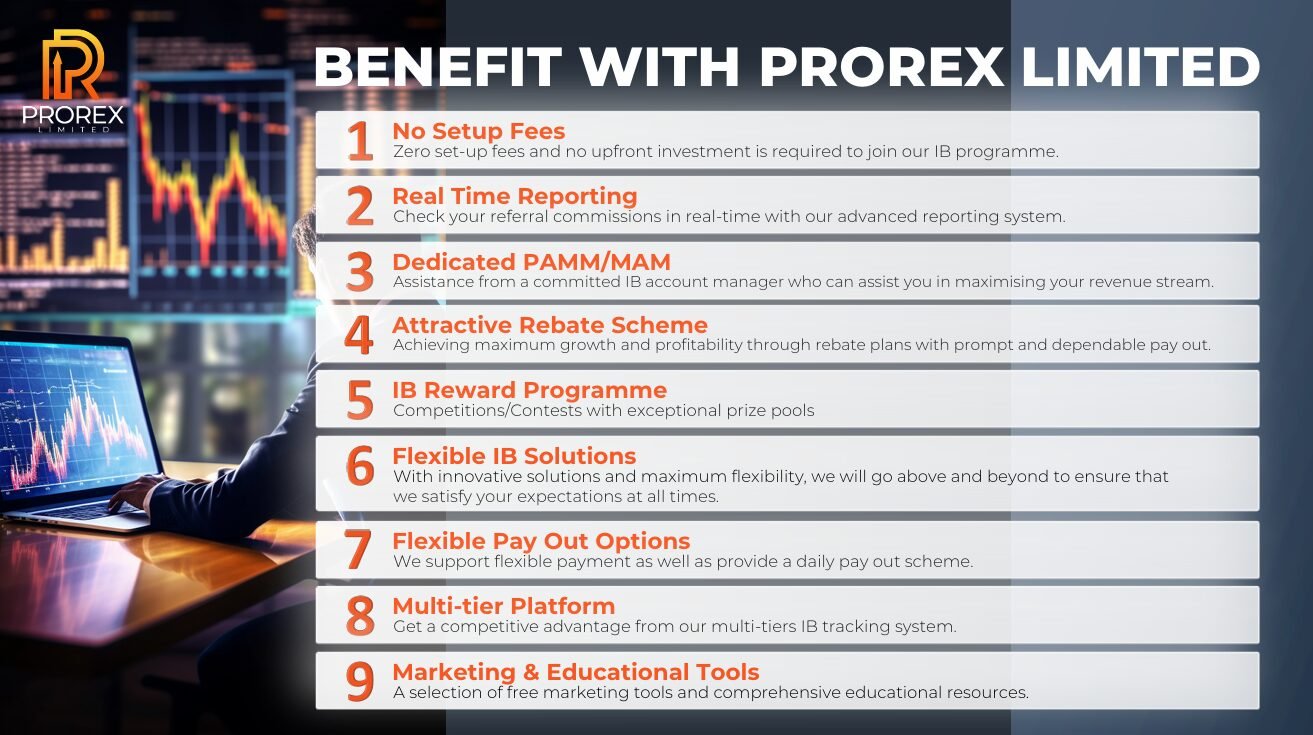

For those on the provider side, publishing strategies can generate additional income through the Prorex revenue share program. The company even layers benefits with IB structures, educational tools, and performance leaderboards—elements that strengthen the broader trading ecosystem.

And while many brokers compete in this space, Prorex positions itself with clear terms: no hidden fees, daily payout options, and competitive rebates. For investors, this transparency makes the Prorex PAMM account not just a tool, but a potential long-term strategy.

Why PAMM and MAM Matter for Investors in 2025

The debate over the best PAMM broker 2025 often comes down to two factors: technology and trust. With Prorex indicators, customizable allocation methods, and the multi account manager (MAM) module, the brand emphasizes flexibility. Meanwhile, features like Prorex free credit promotions and prorex free bonus programs appeal to new traders testing the platform.

Yet, the bigger picture is about access. Whether through prorex copy trade functions or structured it trading, these systems reflect a shift: investors want both autonomy and professional oversight. Tools like Prorex PAMM suggest that the middle ground between independence and guidance may not only be possible but increasingly essential.

Conclusion: The Role of Prorex PAMM in Modern Trading

As managed accounts gain momentum, platforms like Prorex PAMM illustrate how technology can bridge the gap between experienced traders and investors seeking reliable structures. Whether through pamm investment platforms, copy trading systems, or AI-driven strategies, the future of trading looks more collaborative, transparent, and customizable than ever.

【 Prorex Limited 】

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia