Vietnam’s financial landscape is rapidly shifting, with Decentralized Finance (DeFi) becoming a hot topic among investors and everyday traders. While DeFi apps promise financial freedom and borderless transactions, beginner forex brokers and trusted forex platforms continue to hold steady as reliable entry points for Vietnamese traders. In this FAQ, we explore how both systems coexist and why forex brokers still matter in the DeFi era.

1. Why Are Beginner Forex Brokers Still Important in Vietnam’s Crypto-Driven Market?

As DeFi gains momentum in Vietnam, beginner forex brokers remain a valuable resource for those just stepping into the world of trading. These platforms offer simple, guided onboarding experiences that help Vietnamese traders understand essential financial concepts without the immediate risk of losing assets due to technical errors. Unlike DeFi platforms that often require personal wallet management and blockchain literacy, beginner brokers provide structured environments where users can safely make their first trades with traditional currency pairs, offering a learning path before jumping into crypto assets.

2. Can Beginner Forex Brokers and DeFi Apps Work Together in Vietnam?

Interestingly, they already do. Many Vietnamese traders are using trusted forex brokers to manage a stable portion of their portfolios while testing DeFi apps for higher-risk, higher-reward opportunities. Forex brokers typically offer the benefit of regulated operations and customer support, while DeFi apps provide flexibility, peer-to-peer exchanges, and new earning mechanisms like staking and yield farming. Vietnamese traders often blend these strategies, balancing safety with innovation in their personal investment approach.

3. What Are the Key Differences Between Trusted Forex Platforms and DeFi Apps?

The contrast between trusted forex brokers and DeFi apps is significant. Forex brokers usually operate under international regulations and provide users with account protection, leverage options, and educational support. DeFi apps, especially in Vietnam, operate without central authority, meaning that users must fully manage their digital assets and transactions themselves. While DeFi apps allow greater freedom, they also carry a higher risk of technical issues, scams, or irreversible mistakes. Vietnamese traders often appreciate the support systems in forex platforms, especially when starting out.

4. What Risks Should Vietnamese Traders Watch Out for in DeFi?

DeFi offers exciting possibilities but comes with real dangers. Smart contract vulnerabilities, fraudulent platforms, and volatile crypto markets can lead to substantial losses. Vietnamese regulators are still catching up to the rapid growth of decentralized finance, leaving many DeFi users without clear legal protection if something goes wrong. Compared to this, beginner forex brokers offer an environment where certain safety nets—like regulated withdrawals and customer service—are already in place. Many Vietnamese traders, aware of these risks, prefer to build their skills in forex trading before fully committing to DeFi platforms.

5. Are Beginner Forex Brokers Easier for Vietnamese Traders to Start With?

Credit from Blueberry Markets

For most new traders in Vietnam, the answer is yes. Beginner forex brokers often provide demo accounts, simplified mobile apps, and guided educational content in Vietnamese, making it easier to learn step by step. DeFi platforms typically expect users to understand blockchain concepts, cryptocurrency wallet security, and gas fees, which can be confusing for those just starting out. Forex brokers are seen as a practical entry point where Vietnamese traders can safely develop market skills and financial discipline before moving into the more self-directed world of DeFi.

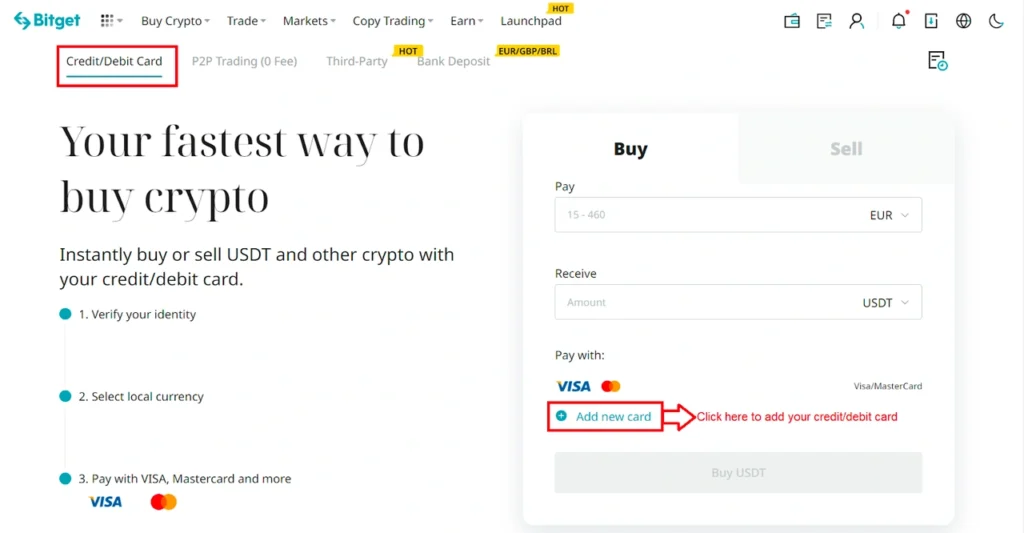

6. Which DeFi Apps Are Attracting Vietnamese Traders?

Credit from Bitget

In Vietnam, DeFi platforms like PancakeSwap, Uniswap, and AAVE are gaining popularity, especially among younger, tech-savvy investors. These apps allow Vietnamese users to trade crypto assets directly, lend or borrow funds, and even earn passive income through staking. However, most users tend to approach DeFi carefully, often starting with smaller investments while keeping the bulk of their funds in trusted forex accounts. This dual-track strategy reflects a growing awareness of DeFi’s potential and its risks.

7. How Is the Vietnamese Government Responding to DeFi and Forex Trading?

Vietnam’s regulatory stance on both forex trading and DeFi is still evolving. While forex trading with regulated international brokers remains popular, cryptocurrency and DeFi activities operate in a legal gray zone. Authorities have issued warnings about scams and unregulated crypto platforms, but no comprehensive legal framework has been finalized yet. For this reason, many Vietnamese traders feel safer working with trusted forex brokers, where certain protections exist, while cautiously exploring DeFi on the side.

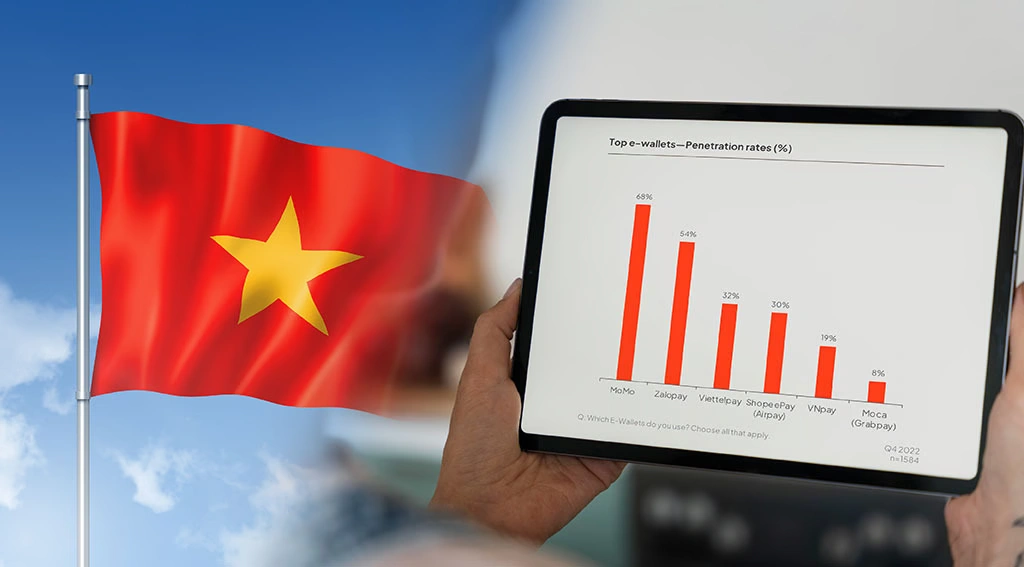

8. Will Trusted Forex Brokers Remain Relevant as DeFi Grows in Vietnam?

Credit from Fintech News Singapore

It’s likely that trusted forex brokers will continue to play a critical role, even as DeFi reshapes the financial landscape in Vietnam. Forex platforms offer stability, education, and regulatory oversight—advantages that DeFi cannot fully provide at this stage. Vietnamese traders seem to value this balance: using forex brokers for structured learning and portfolio security, while selectively exploring DeFi opportunities to diversify and stay current with global financial trends.

Conclusion: The Enduring Role of Beginner Forex Brokers in Vietnam’s DeFi Journey

As Vietnam embraces decentralized finance, beginner forex brokers and trusted forex platforms continue to serve as important stepping stones for traders. These brokers provide a safer, more regulated space for beginners to learn, practice, and build confidence before venturing into the complex world of DeFi apps. For Vietnamese traders, combining both platforms offers a smart, balanced way to engage with the future of finance while managing personal risk.