In 2025, BI forex intervention is once again in the spotlight. With the global financial climate still marked by high interest rate environments, lingering geopolitical friction, and shifting investor appetite, Bank Indonesia has had to respond to currency pressure with a mix of decisiveness and subtlety.

The rupiah, like many emerging market currencies, has faced renewed bouts of volatility. While Indonesia’s fundamentals remain relatively strong—supported by commodity exports and manageable inflation—the central bank hasn’t left the currency adrift. This year’s interventions reflect a familiar theme: allowing market forces to operate, but not letting them spiral.

A Return to Active Management, But Not Overreach

Source: The Diplomat

The start of 2025 has already seen several moments of market stress: a surprise Fed rate hike in February, a dip in global oil prices, and renewed tensions in regional trade policy. Each of these events triggered capital flows and speculative adjustments in Southeast Asia’s currencies.

Bank Indonesia responded—though not by pegging or forcefully controlling the rupiah. Instead, it adopted a more refined strategy, intervening at targeted points to reduce volatility. This trend points to a consistent policy stance: BI seeks to reduce market “noise,” not mute the entire conversation.

DNDF Instruments Gain Popularity in 2025 Intervention Mix

A key feature of 2025’s strategy has been the increasing reliance on Domestic Non-Deliverable Forwards (DNDFs). These derivatives allow banks and investors to hedge currency risks without physical delivery, providing smoother expectations in the forex market.

Compared to spot interventions, DNDFs offer BI a way to guide future pricing behavior rather than reacting only to current pressures. This forward-looking posture is aligned with global best practices and supports a more stable rupiah in a complex market environment.

BI forex intervention: Forex Reserves Are Holding Up—A Quiet Vote of Confidence

Source: TradingEconomics

Despite multiple interventions this year, Bank Indonesia’s foreign reserves have remained largely intact. As of mid-2025, they are still above USD 130 billion—a comfortable level that signals BI is not overextending itself.

This reinforces the perception that BI’s interventions are tactical and limited in scope. Rather than draining reserves to defend arbitrary levels, the bank is using measured moves to preserve rupiah credibility while maintaining macroeconomic buffers.

BI forex intervention: Market Reactions Have Been Muted—Exactly as Planned

Source: Reuters

Another trend worth noting: BI’s moves in the forex market this year have not spooked investors. This is in contrast to previous periods (like early 2020 or 2018) when interventions triggered market nervousness.

Why the change? BI’s communication in 2025 has matured. Through consistent messaging, regular monetary updates, and data transparency, the central bank has made it clear that intervention is part of its stability framework—not a panic response. This credibility has allowed the bank to act quietly, without stirring negative sentiment.

Intervention Without Disruption: The Balancing Act Continues

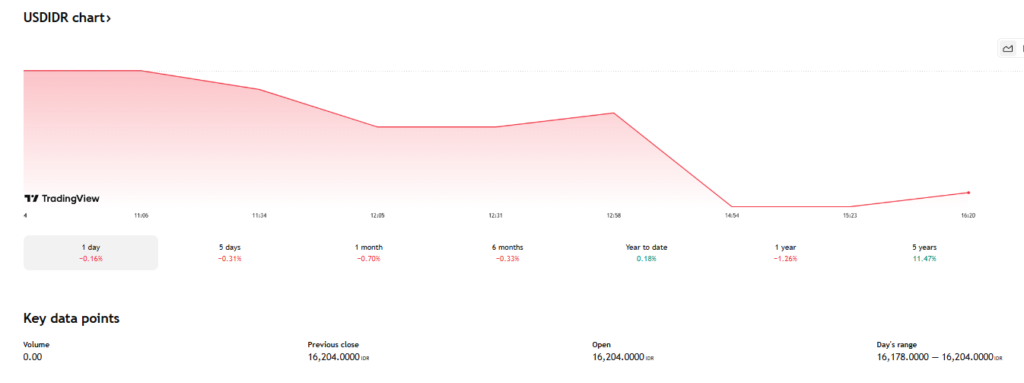

Source: TradingView

Indonesia’s monetary authorities remain committed to market stability without stifling market function. That balance has defined BI’s forex playbook throughout 2025. Instead of forcing the rupiah into narrow bands, the bank is managing volatility margins—nudging the currency when moves become too sharp or sentiment turns too aggressive.

This strategy acknowledges a truth familiar to modern central banks: you can’t stop capital flows, but you can shape how markets respond to shocks.

What to Watch Moving Forward

Heading into the second half of 2025, several questions loom:

Will the Fed cut rates? Will commodity prices rebound? Will China’s economy regain momentum? Each of these external variables will shape the rupiah’s path—and thus BI’s response.

However, one trend is likely to continue: BI forex intervention will remain selective, data-driven, and confidence-oriented. Whether through DNDFs, spot interventions, or liquidity injections, Bank Indonesia is signaling its continued commitment to a managed float system—one that supports growth while cushioning volatility.

Conclusion: BI Forex Intervention 2025 Reflects a Strategic, Evolved Currency Policy

So far, BI forex intervention in 2025 has confirmed a longer-term trend: Indonesia’s central bank is becoming more precise, less reactive, and increasingly transparent in its approach to managing currency pressures. Rather than treating intervention as a last resort, BI is integrating it into its broader policy toolkit—especially when the external environment remains fragile.

For investors, businesses, and ordinary Indonesians alike, the result is greater predictability—even in uncertain times. And in today’s market, that kind of stability is a strategic asset in itself.