If you’ve been around the crypto scene in Singapore lately, you’ve probably noticed how often Ethereum staking comes up. It’s no longer something only hardcore crypto enthusiasts talk about. The shift to Proof-of-Stake (PoS) changed everything—staking feels cleaner, simpler, and, honestly, a little more predictable than the old mining days.

The appeal isn’t hard to understand. Instead of letting ETH sit idle, staking lets you earn passive rewards while supporting the network. In 2025, yields hover between 4% and 6% annually, which, let’s be honest, is a lot better than what most savings accounts offer. That said, staking isn’t magic money; ETH’s price still moves like any crypto, and that’s part of the game.

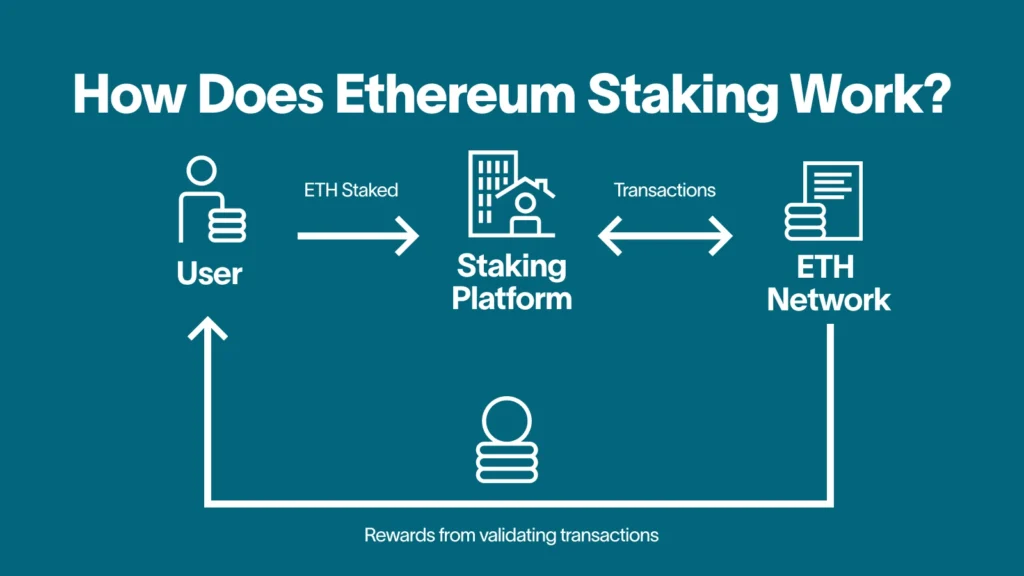

How Ethereum Staking Works (Without the Tech Jargon)

Credit From: ledn

Think of staking like locking your ETH into a digital vault that helps run the Ethereum network. In return, you get paid a sort of “thank you” reward in ETH. There’s no need for heavy computers or expensive setups—staking is more about commitment than computing power.

For Singapore-based investors, the easiest way to start is through exchanges like Coinbase or Kraken. They do all the validator work behind the scenes. If you want more control, decentralized options like Lido or Rocket Pool let you stake while keeping liquidity via tokens like stETH. It’s like earning interest while still being able to move your funds if needed.

Here’s a quick snapshot of how platforms compare this year:

| Platform | Estimated Yield (2025) | Lock-up Period |

|---|---|---|

| Coinbase Singapore | 4.5%–5% | 7 days |

| Kraken Singapore | 4%–4.8% | Flexible |

| Lido (DeFi) | 4%–4.5% | No lock-up (stETH) |

Ethereum Staking and MAS Rules

Credit From: changelly

Regulation always sounds scary, but in Singapore it’s more about clarity than restriction. The Monetary Authority of Singapore (MAS) hasn’t banned staking. Instead, they’ve rolled out investor protection measures that require platforms to be upfront about risks like volatility or validator penalties. That means if you stake through a MAS-licensed exchange, they’re legally obliged to keep customer funds separate and maintain proper security measures.

This approach has actually made the staking scene more trustworthy. Platforms now implement cold storage, multi-signature wallets, and even insurance coverage for staked ETH. So while you still have to do your homework, the overall environment feels a lot safer than just a few years ago.

Why 2025 Feels Different

Credit From: wallstreetmojo

Since Ethereum’s Merge in 2022, staking has become less of a “tech experiment” and more of a real investment strategy. Yields have stabilized, network performance is stronger, and Singapore’s crypto-friendly stance has given investors confidence. What’s really catching on now is liquid staking, which means you don’t have to fully lock your ETH. Services like Lido have made it easy for people to earn rewards while still holding a flexible asset they can trade or use elsewhere.

The Risks People Don’t Talk About Enough

Credit From: riskacademy

It’s easy to get excited about “free” ETH rewards, but staking isn’t risk-free. ETH prices can drop, which reduces the real value of your rewards. Smart contract bugs are another risk with DeFi protocols. On centralized exchanges, you’re trusting them with your keys—which means you’re betting on their security and compliance.

A good rule of thumb? Don’t stake everything in one place. Mix centralized and decentralized platforms, and only stake what you can afford to keep locked for a while. That balance is what seasoned investors stick to.

Ethereum Staking Singapore Is Growing Up

Ethereum staking Singapore is no longer something experimental. It’s becoming part of the mainstream crypto strategy for both casual and serious investors. The combination of stable yields, better regulations, and reliable platforms makes 2025 a great time to get involved—if you know the risks and pick the right platform.

Start small, get comfortable, and don’t treat staking as a quick money grab. Think of it like planting seeds. The rewards grow over time, and with the right mix of patience and research, it could become a solid part of your long-term digital portfolio.