Not too long ago, the Ethereum vs Bitcoin Singapore debate felt like a coin toss—two giants battling for dominance, mostly judged by price and popularity. But things look different in 2025. The conversation has shifted. Instead of speculative comparisons, more people are asking which network fits better into Singapore’s forward-looking regulatory and tech ecosystem.

Below are the questions that keep popping up in conversations here—from institutional circles to Web3 meetups. Let’s explore them.

1. Why is Ethereum gaining momentum in Singapore over Bitcoin?

Created By forkast.news

Ethereum isn’t just a tech platform anymore. In Singapore, it’s quickly becoming the preferred blockchain for experimentation, thanks to its flexibility and regulatory alignment.

In areas like ESG reporting, tokenized finance, and compliance automation, people in Singapore are actively choosing Ethereum for its flexibility. Developers can build tools that adapt to real-world regulatory demands. Bitcoin, while still dominant in store-of-value use cases, simply doesn’t offer the same level of programmability. And in a place where tech must align with oversight, that capability matters.

2. How Are Smart Contracts Shaping the Ethereum vs Bitcoin Singapore Debate?

Created By solulab

Unlike in many global markets, Ethereum smart contracts in Singapore are being deployed for more than just DeFi.

Legal tech pilots use them for digital contracts. Tokenized assets, including real estate and securities, embed logic that enforces compliance. Carbon credit platforms run on Ethereum to validate transactions transparently. These aren’t ideas—they’re projects already happening in regulatory sandboxes.

3. What role does MAS Project Guardian play in this shift?

MAS Project Guardian is one of the most significant regulatory sandboxes in Asia’s crypto landscape. And much of what’s happening inside it points toward Ethereum.

From tokenized deposits to institutional DeFi, the majority of test cases under Project Guardian rely on Ethereum-compatible infrastructure. Bitcoin isn’t excluded—but it doesn’t offer the same programmability, which limits its relevance for these regulated experiments.

4. Does The Merge still matter in 2025?

Yes. While The Ethereum Merge impact made headlines in 2022, its relevance has matured.

Today, it forms the backbone of ESG crypto investing in Singapore. Environmental sustainability is baked into regulatory expectations, especially for finance-linked projects. Ethereum’s proof-of-stake model helps institutions tick those boxes, while Bitcoin’s energy-intensive proof-of-work model remains a concern.

5. Why is tokenization in Singapore gravitating toward Ethereum?

Created By thecryptogateway

Tokenization in Singapore is on the rise—and Ethereum is its go-to infrastructure.

Thanks to well-established standards like ERC-1400 and ERC-3643, Ethereum lets issuers build digital assets with built-in rules. This makes audits, compliance checks, and investor onboarding far more straightforward, which is vital when dealing with MAS.

Bitcoin, by contrast, lacks the native flexibility to meet these demands.

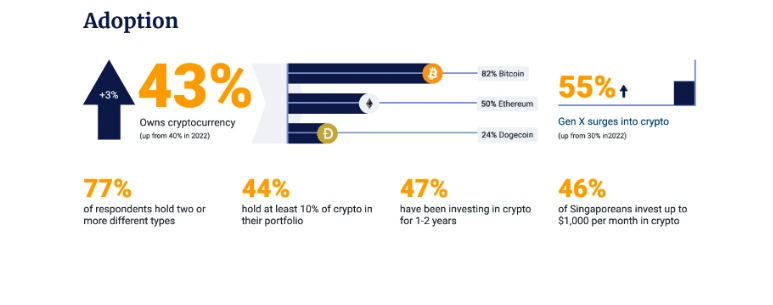

6. What does local adoption say about Ethereum vs Bitcoin Singapore?

Created By pexx

It says a lot, actually. Crypto adoption in Singapore favors platforms that can do more than just store value.

Ethereum powers local wallets, NFT marketplaces, tokenized real estate apps, and more. While Bitcoin is widely respected, its use is more limited to storage and trading. If utility is the metric, Ethereum is clearly leading.