Let’s face it — the rupiah’s value doesn’t always behave. And in a time when the economy feels unpredictable, more Indonesians are turning to gold as a backup plan. If you’ve come across the term gold hedge rupiah but aren’t exactly sure what it means or how to do it, this tutorial is for you.

Hedging with gold doesn’t require you to be rich or financially “advanced.” It’s simply about adding a layer of protection — especially when your currency is losing strength.

Step 1: Know What a Gold Hedge Really Is

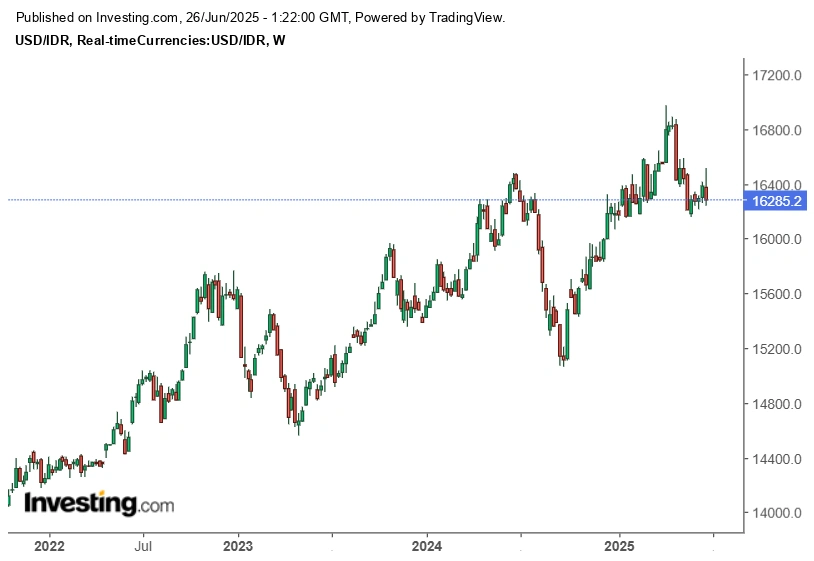

Source: Investing.com

To hedge basically means to reduce risk. A gold hedge rupiah strategy involves buying gold to balance out potential losses from a weakening rupiah. Since gold is priced in USD, its value in rupiah tends to rise when the local currency drops. That means if IDR weakens, your gold becomes more valuable — helping you offset the loss.

You’re not trying to make fast money. You’re trying to hold onto value.

Step 2: Identify the Right Time to Hedge

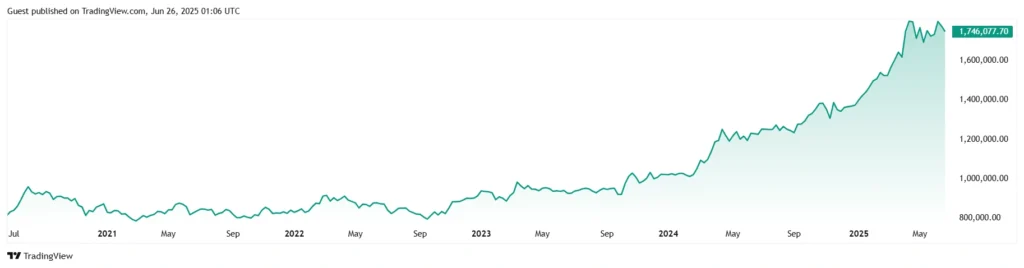

Source: TradingView

While there’s no perfect signal, these clues might tell you it’s time to take action:

- The rupiah is steadily falling against the US dollar

- Prices of imports and fuel are going up

- Inflation is climbing — and your money buys less each month

- You feel uneasy leaving all your savings in IDR

If these sound familiar, a small hedge with gold might bring you peace of mind.

Step 3: Decide on Your Gold Type

Not all gold is created equal — and you’ve got options. Here’s what to consider:

- Physical gold: Bars, coins, or jewelry — traditional, but you’ll need safe storage

- Digital gold: Buy fractions of gold via trusted apps like Pluang, Lakuemas, or Tokopedia Emas — simple and beginner-friendly

- Gold ETFs or funds: Great if you’re already investing in mutual funds or using online brokers

The best option? The one you understand and can access easily. You can always start small — even 0.5g makes a difference.

Step 4: Budget the Right Amount

Going “all in” on gold? Not necessary — and not recommended. Many financial advisors suggest putting 5% to 15% of your total savings into gold as a hedge. It’s not about betting — it’s about balancing.

Think of gold as the seatbelt in your financial car — you hope you don’t need it, but it’s there if things get rough.

Step 5: Avoid Sneaky Costs

Some gold products come with hidden fees — and they eat into your returns. Be sure to:

- Check the spread between buying and selling prices

- Review platform charges or annual storage fees

- Know if physical gold comes with a premium or handling cost

Every little fee adds up, so choose wisely and read the fine print before committing.

Step 6: Stay Updated, Not Obsessed

No need to stare at gold charts daily — that’s not the goal. But it is smart to keep tabs on:

- USD to IDR exchange rates

- Inflation reports

- Major global economic headlines

Just a monthly check-in is often enough to see whether your gold hedge is doing its job.

Step 7: Reassess as the Economy Shifts

The rupiah won’t stay weak forever. When the economy stabilizes, you may want to adjust your position — either cash out some gold or reduce your exposure. Flexibility is key. A good hedge is one you can change as the winds shift.

Final Thoughts

Using gold as a gold hedge rupiah strategy isn’t about panic — it’s about preparation. In a world where the rupiah faces ups and downs, gold offers steady footing.

So whether you’re just starting to save, or simply want to protect what you’ve built, gold can be a smart, simple step forward. You don’t need to be an expert — you just need a plan.