Gold Tokenization Indonesia 2025: In Indonesia, gold is more than an asset—it’s a legacy, a savings tool, and a symbol of security. But as financial technology advances and Web3 becomes more mainstream, a new model is emerging: gold tokenization Indonesia. By 2025, this trend is no longer just a speculative tech experiment; it’s a fast-maturing financial ecosystem. Platforms now allow Indonesians to invest in blockchain-based tokens that are 100% backed by physical gold stored in secure vaults. These tokens are traceable, divisible, and transferable, offering a new level of control and transparency. In a country where trust in gold runs deep, the combination of cultural value and digital flexibility is proving highly appealing—especially to millennials and Gen Z investors who want both security and autonomy.

Rising Adoption: Gold Tokenization Indonesia 2025- Why 2025 Is a Breakthrough Year for Tokenized Gold

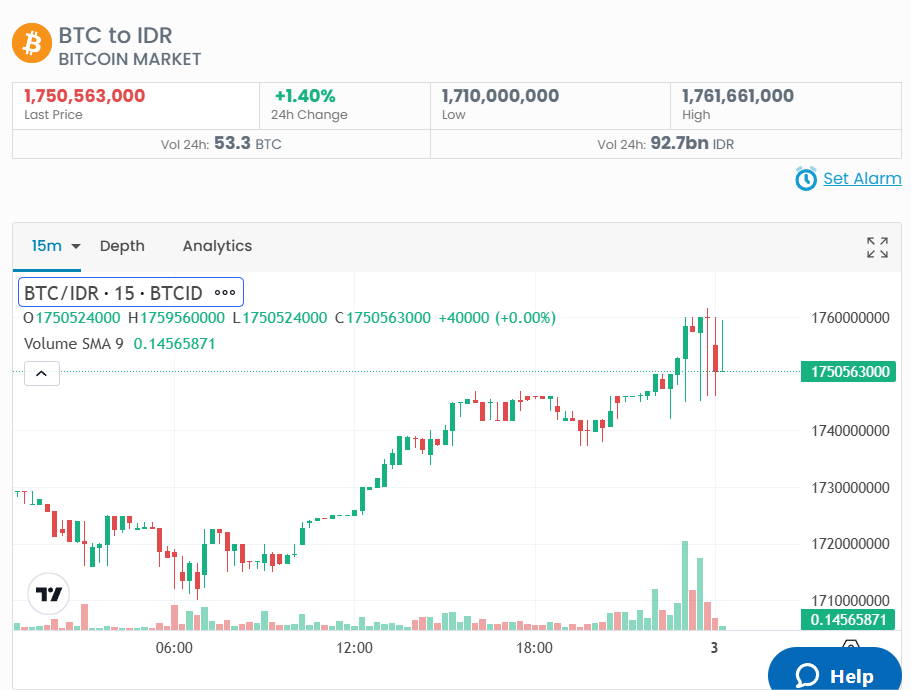

Source: INDODAX

Data from early 2025 shows a marked increase in Indonesian participation in tokenized gold platforms. Several factors contribute to this rise: increased financial literacy, growing smartphone penetration, and a more favorable stance from regulators like BAPPEBTI. Importantly, tokenized gold offers access to gold ownership without the burdens of physical storage or large upfront investment. People can now buy gold starting from 0.01 grams and track their holdings in real time using mobile apps integrated with Web3 wallets. These capabilities have democratized gold investing across social classes and age groups. Unlike traditional banking systems that often gatekeep access, gold tokenization Indonesia platforms are open, borderless, and always on—perfectly aligned with the digital-native behavior of the younger population.

From Static Asset to Dynamic Utility: Gold Tokenization Indonesia 2025- The Use of Gold in DeFi

Source: Kiplinger

One of the most significant shifts in 2025 is how tokenized gold is no longer just being held—it’s being put to work. Through decentralized finance (DeFi) platforms, gold tokens are used as collateral for loans, yield-bearing assets in liquidity pools, and even as part of automated savings plans. In short, gold tokenization Indonesia has redefined what it means to “own” gold. You’re not just storing value—you’re actively integrating it into a living, programmable financial system. This utility is attracting investors who seek stability but still want to benefit from the higher returns associated with crypto-based tools. Platforms are beginning to build gold-native DeFi products, allowing users to earn interest without ever giving up the underlying asset—a radical departure from the passive role gold traditionally plays.

Tech Meets Trust: Platforms Are Getting More Sophisticated and Safer

As tokenized gold expands, so does the sophistication of the platforms offering it. In 2025, the top players in gold tokenization Indonesia have added real-time vault audits, transparent smart contracts, and identity verification that meets local compliance standards. These platforms are not just fintech apps—they’re emerging as hybrid institutions that combine the credibility of traditional finance with the innovation of blockchain. Token holders can see proof-of-reserves anytime, access historical vault data, and verify their holdings directly on-chain. The result is a trust system based not on promises, but on public data. As more Indonesians look to protect their savings from inflation or diversify their crypto portfolios, this transparency offers real psychological comfort in a market often clouded by hype and uncertainty.

A Shift in Investor Mindset: Gold as a Liquid and Portable Asset

Source: Cryptonomist

What’s truly changing in 2025 isn’t just technology—it’s mindset. Gold is no longer viewed solely as a physical, illiquid asset that sits in a drawer or vault. Tokenization has reframed it as something active, mobile, and even social. People can now send tokenized gold as payment, gift it as part of a wedding dowry, or include it in group savings programs via decentralized smart contracts. This shift has massive implications for how Indonesians perceive long-term value. In a world increasingly driven by speed, connectivity, and digital access, gold tokenization Indonesia gives gold a new kind of relevance. It becomes more than a symbol—it becomes a usable currency in a decentralized financial system that never sleeps.

Government and Regulatory Support: The Quiet Engine Behind the Growth

One often-overlooked trend driving tokenized gold in Indonesia is the quiet but steady support from regulators. In 2025, BAPPEBTI and OJK have begun laying clearer guidelines for the classification and treatment of crypto commodities, including gold-backed tokens. While the sector is still maturing, this emerging framework is encouraging institutional participation and enabling consumer protection. Several fintechs now partner with licensed vaults and regulated crypto exchanges to offer gold tokens within well-defined legal structures. This legitimization has opened the door for risk-averse investors, including those previously skeptical of digital assets. It’s also creating new business models—such as zakat and hajj savings powered by tokenized gold—that are tailored for Indonesia’s majority-Muslim population. The result is a more inclusive and trusted financial environment.

The Road Ahead: What to Watch in the Next Phase of Gold Tokenization

Source: PAYTM

Looking ahead, the future of gold tokenization Indonesia appears full of momentum and possibility. We may soon see tokenized gold integrated into broader national financial systems, from micro-pension schemes to central bank digital currency (CBDC) interfaces. There’s also growing interest in making tokenized gold spendable via QRIS systems, effectively turning a 5,000-year-old asset into everyday payment. Cross-border applications are emerging too—tokenized gold could become a remittance tool, allowing Indonesians abroad to send value home in a stable, universally accepted format. The next wave of innovation will likely focus on interoperability, multi-chain access, and deeper DeFi use cases. If 2024 was the year of early adoption, then 2025 is shaping up to be the year of integration—and possibly, normalization.

Conclusion: In 2025, Gold Tokenization in Indonesia Is No Longer Optional—It’s Inevitable

What began as a niche experiment is now reshaping the national financial landscape. In 2025, gold tokenization Indonesia is proving that when tradition meets technology, powerful things happen. It gives everyday people—not just institutions—a way to access and interact with gold on their own terms. It fits seamlessly into the growing Web3 economy and respects Indonesia’s long-standing cultural affinity for precious metals. Whether you’re an investor seeking stability, a developer building new tools, or just someone who wants to hold gold without the hassle, tokenized gold offers a modern solution rooted in ancient value. And it’s not just the future—it’s already here.