MACD RSI for Forex Indonesia: The forex market in Indonesia is influenced by a blend of global trends and local developments — from commodity prices to Bank Indonesia’s policy signals. For traders navigating this complexity, price action alone often isn’t enough. Indicators like MACD RSI for Forex Indonesia offer structured insights to help make trading more data-driven. These tools don’t just confirm price movements but add a layer of context, showing when trends have momentum or when they might be losing steam. Indonesian traders use them to reduce uncertainty and avoid emotional decisions, especially in volatile market environments where clarity is critical.

MACD RSI for Forex Indonesia: Learn the Basics of MACD and How It Helps Spot Trend Shifts

The MACD indicator tracks the relationship between two exponential moving averages — usually the 12-day and 26-day EMAs — along with a signal line that reflects the 9-day EMA. What makes MACD useful is how it simplifies trend analysis. When the MACD line crosses above the signal line, it often suggests increasing bullish momentum. When it crosses below, the trend may be weakening. In Indonesia’s forex space, traders use MACD not only to detect trends in pairs like USD/IDR but also to confirm breakouts or monitor for reversals during major sessions or macroeconomic updates.

MACD RSI for Forex Indonesia: Use RSI to Gauge Whether a Move Is Too Strong or Too Weak

Source: Mind Math Money

The Relative Strength Index (RSI) helps traders understand if a price movement is sustainable or due for a correction. Operating on a scale of 0 to 100, RSI gives clues when an asset is overbought (above 70) or oversold (below 30). In the Indonesian context, RSI becomes particularly important during rapid price changes — such as after GDP announcements or external news like shifts in U.S. interest rates. A strong move may seem tempting, but RSI offers that moment of pause, helping traders confirm whether they’re entering too late or at the right moment. It’s especially helpful when paired with MACD.

MACD RSI for Forex Indonesia: Combine MACD and RSI to Build Stronger Trading Setups

The power of MACD RSI for Forex Indonesia comes from how they complement each other. MACD gives directional bias and trend confirmation, while RSI gives a sense of how intense that trend is. Many traders in Indonesia wait for both indicators to align before acting. For example, when MACD turns bullish and RSI is rising but not yet in overbought territory, it’s a potential signal for an entry. If MACD is bearish but RSI still shows neutral strength, it might be wise to hold off. This layered approach reduces the chances of being misled by short-term price action.

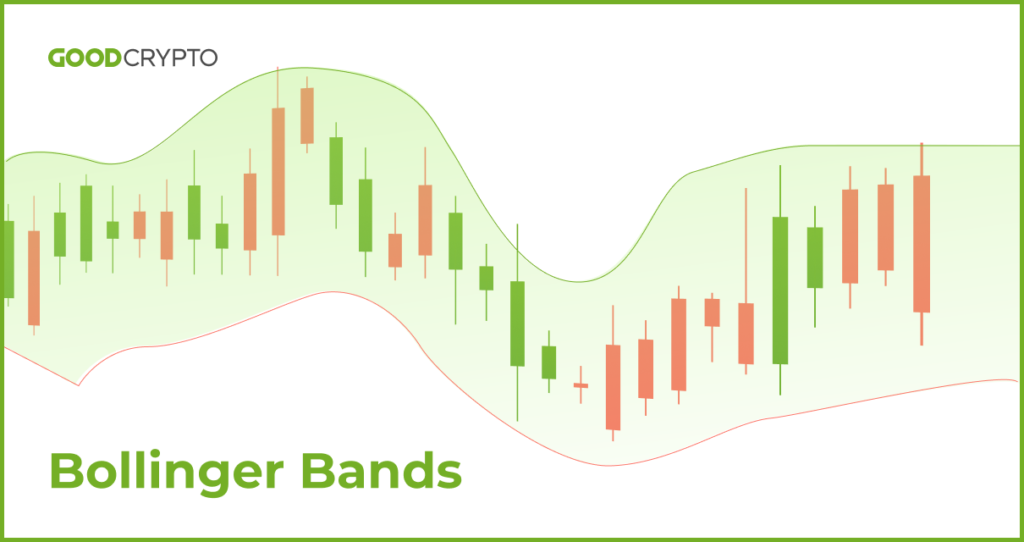

Add Bollinger Bands to Measure Price Volatility

Source: Good Crypto

Bollinger Bands add another level of insight by showing how volatile the market is and where price extremes may lie. Built around a simple moving average with bands set two standard deviations away, they expand during volatility and contract when things calm down. In the Indonesian market — where pairs can move sharply due to oil prices or trade news — Bollinger Bands help spot moments of exhaustion or pending breakouts. Traders often use them alongside MACD and RSI. A price touching the lower band with rising RSI and a bullish MACD signal might suggest a potential reversal. This trio helps fine-tune timing.

Use Moving Averages for a Bigger Picture of Market Direction

Moving averages smooth out price data to help identify long-term trends. Indonesian traders use different types — like the 50-day simple moving average (SMA) or 20-day exponential moving average (EMA) — depending on the strategy. These are especially useful when you want to understand trend structure over time. If MACD turns positive and price is holding above a key moving average, while RSI confirms upward strength, the setup becomes more credible. MAs also serve as dynamic support or resistance areas, which traders in Indonesia monitor during overlapping sessions with Tokyo, Singapore, or London.

Use the Stochastic Oscillator for Sharper Entry Timing

The stochastic oscillator is another momentum tool that compares current price to a recent range. It generates %K and %D lines and is typically used to detect potential reversals or exhaustion points. While similar to RSI, it responds faster, which is why Indonesian day traders often favor it during high-impact news periods. For example, if MACD is bullish and RSI is climbing, but stochastic is already showing a bearish crossover in overbought territory, the trader might wait for a pullback. This tool sharpens timing and gives added confirmation for short-term positions.

Use Indicators with Market Context, Not in Isolation

While indicators like MACD and RSI are helpful, relying on them blindly can lead to errors. A MACD crossover during illiquid hours or in the absence of supporting data may not hold. Likewise, over-analyzing multiple indicators can lead to “paralysis by analysis.” Indonesian traders are encouraged to treat indicators as one part of a broader framework — combining them with chart patterns, support/resistance levels, and economic news. The key is context. Indicators guide your thinking, but judgment, experience, and risk control determine how well they’re applied. Successful use of MACD RSI for Forex Indonesia comes from balance, not just automation.

Why MACD and RSI Will Remain Valuable Tools in 2025

Source: BrookerXplorer

Even as algorithmic tools and AI-assisted trading systems become more common, MACD RSI for Forex Indonesia remain reliable for both beginners and experienced traders. Their visual simplicity and cross-confirmation ability make them useful in any trading style — from swing trades to scalping. In 2025’s highly reactive markets, having a consistent method to interpret momentum and trend will continue to matter. For Indonesian traders balancing fast news flow, global price shifts, and local macro drivers, MACD and RSI provide a clear and proven way to analyze setups and avoid guesswork. That’s why they’re still foundational tools for those looking to trade with discipline.