In the ever-shifting landscape of forex trading, traders weigh countless variables when selecting a brokerage partner. As we move through 2025, traders are becoming more discerning, looking past flashy bonuses to the core mechanics of a platform. It’s within this context that many are conducting a closer analysis of their options, leading to a deeper look into the structure of a Prorex investment and how it fits into the broader ecosystem of online trading.

Content

Breaking Down the Prorex Trading Platform

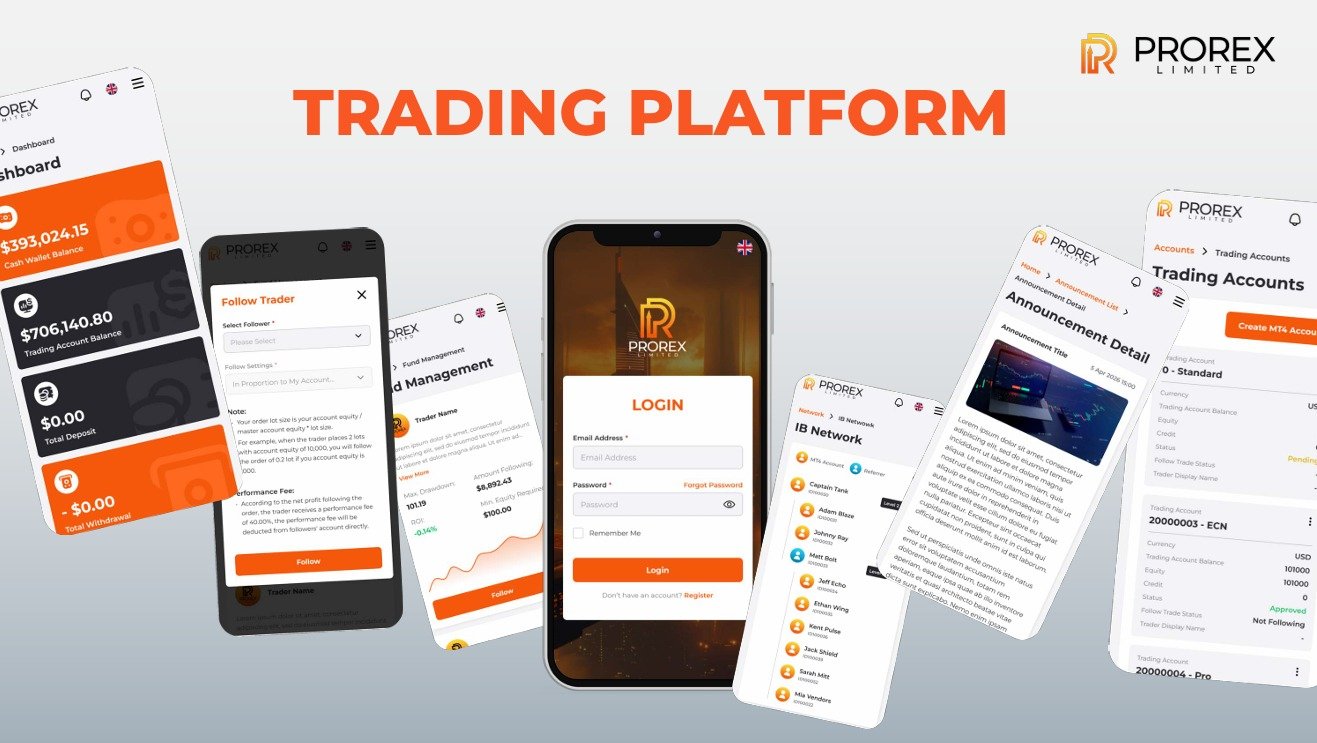

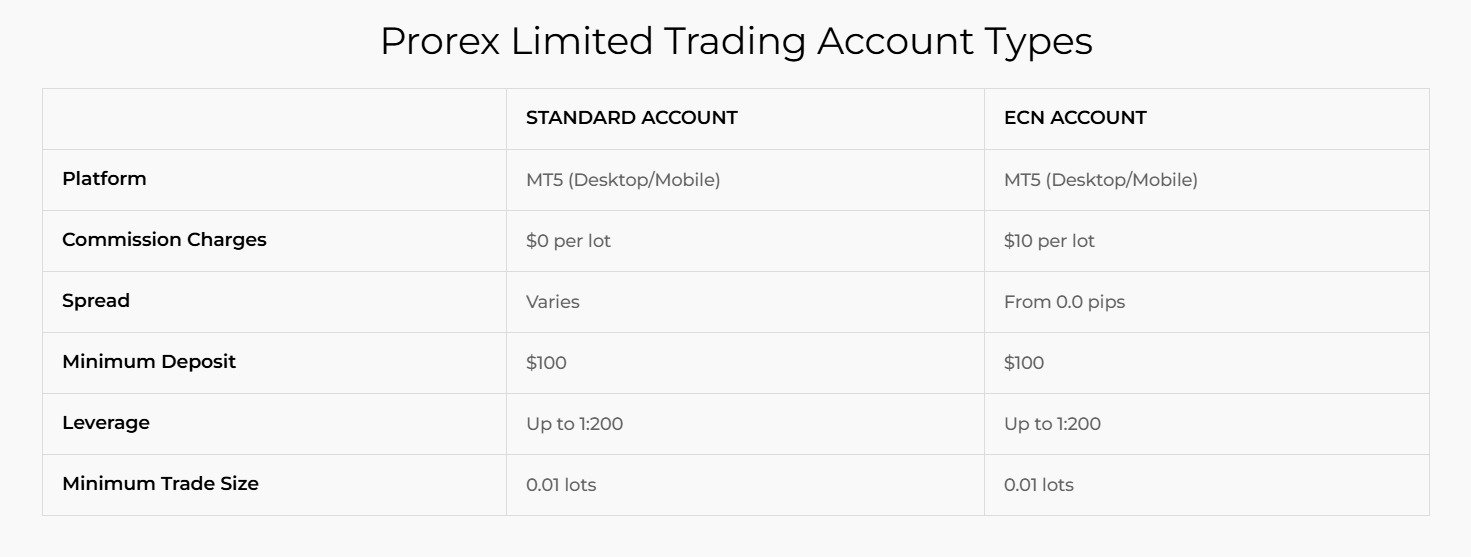

A trader’s primary interface with the market is their trading platform, and its stability is non-negotiable. Prorex, like many contemporaries, seems to build its service around the MetaTrader platforms. This is a familiar environment for seasoned traders, offering a sense of continuity and access to a wide array of existing indicators and automated trading tools. For those just starting, the learning curve is well-documented. The discussion around the prorex trading platform often centers on execution speed and the prorex spread. Traders cover the spread, which represents the cost between the bid and ask price. It’s worth noting that these can be variable, influenced by market volatility and the specific Prorex account types a user selects. This isn’t unique to Prorex, but it’s a crucial detail in any trader’s profitability calculation.

Understanding the Framework of a Prorex Investment

When we explore a Prorex investment, we see how traders shape the ecosystem around their capital through every decision. This starts with the entry point—the prorex minimum deposit. Brokers often tier their services, and Prorex appears to follow this model, offering different account levels that may provide tighter spreads or other perks in exchange for a higher initial deposit. The logistics of moving money are also a key consideration. The efficiency of Prorex deposit and withdrawal processes is a frequent topic in user discussions, as seamless access to funds is a baseline expectation. From an analytical standpoint, the variety of account types suggests an attempt to cater to a broad spectrum of traders, from novices to those with more significant capital and experience.

Regulation and Signals: The Trust Factor in a Prorex Investment

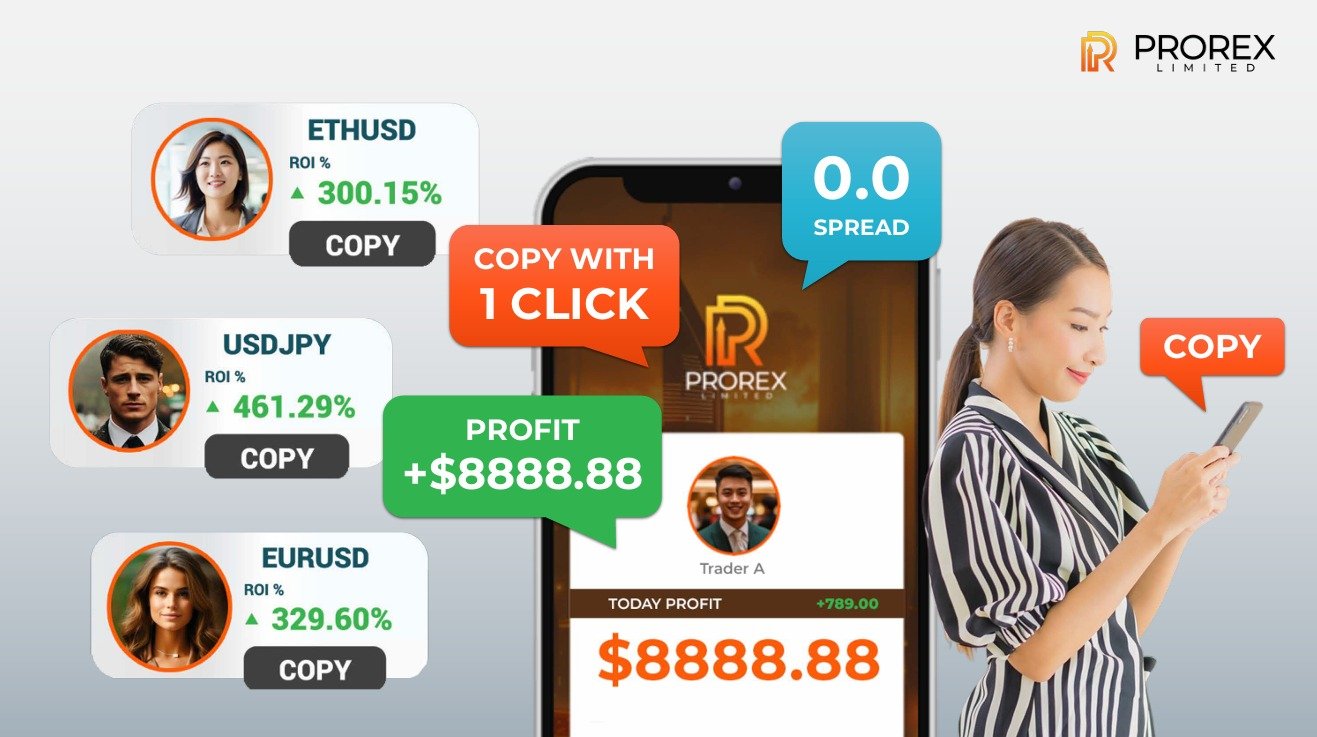

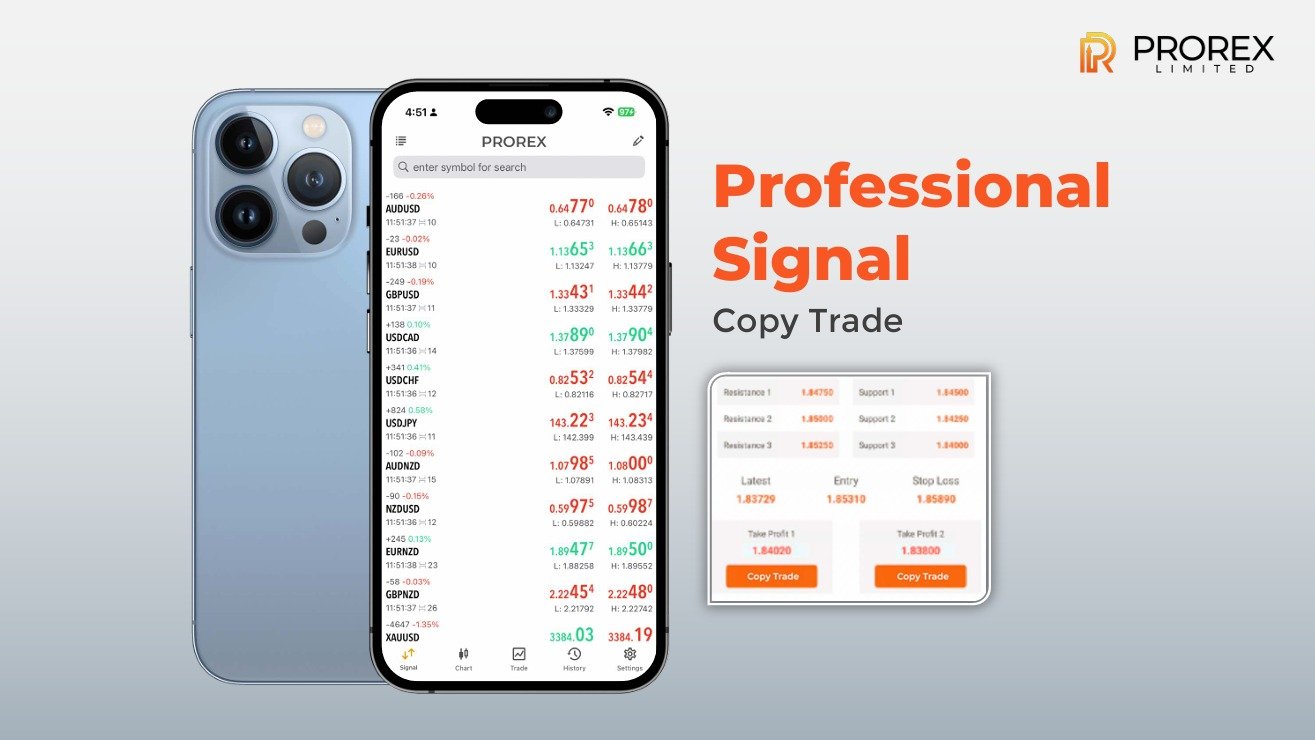

Perhaps the most critical questions revolve around security and support tools. A recurring question is, “Is Prorex regulated?” The matter of Prorex regulation is a fundamental checkpoint. Traders should always perform their own Prorex license verification by checking the stated regulatory body’s public register. This provides a layer of assurance that the broker operates under a specific framework of rules. Beyond security, many traders are interested in supplementary tools like prorex trading signals. While some platforms offer these as a guide, their utility is always a point of debate. The prorex trading signals accuracy would depend heavily on the methodology behind them. Experienced traders often use such signals as one data point among many, rather than a standalone directive for making trades. It’s a tool, and like any tool, its effectiveness is determined by the skill of the user.

Prorex Investment

In conclusion, assessing the viability of any brokerage requires a multi-faceted approach. Looking into a Prorex investment is no different. It involves a pragmatic evaluation of its trading infrastructure, the costs involved, the accessibility of funds, and—most importantly—its regulatory standing. While features like a Prorex trading bonus might be attractive, they are secondary to the foundational elements that support a sustainable trading career. The best forex trading platforms are ultimately those that align with an individual’s specific strategy, risk tolerance, and need for a secure, reliable trading environment.

Register PROREX member NOW! Click HERE

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia