Stepping into the world of online trading often begins with a single, yet significant, choice: the account you open. This decision sets the foundation for your entire trading experience. For those in Malaysia exploring their options, a closer look at what a Prorex trading account entails is a practical starting point. It’s not about finding a magic key to the markets, but about understanding the tools and environment you’ll be working with. This process involves looking past the marketing and getting a real feel for the platform, its costs, and whether its structure aligns with your personal investment goals.

Content

Beyond the Basics: What Defines a Prorex Trading Account?

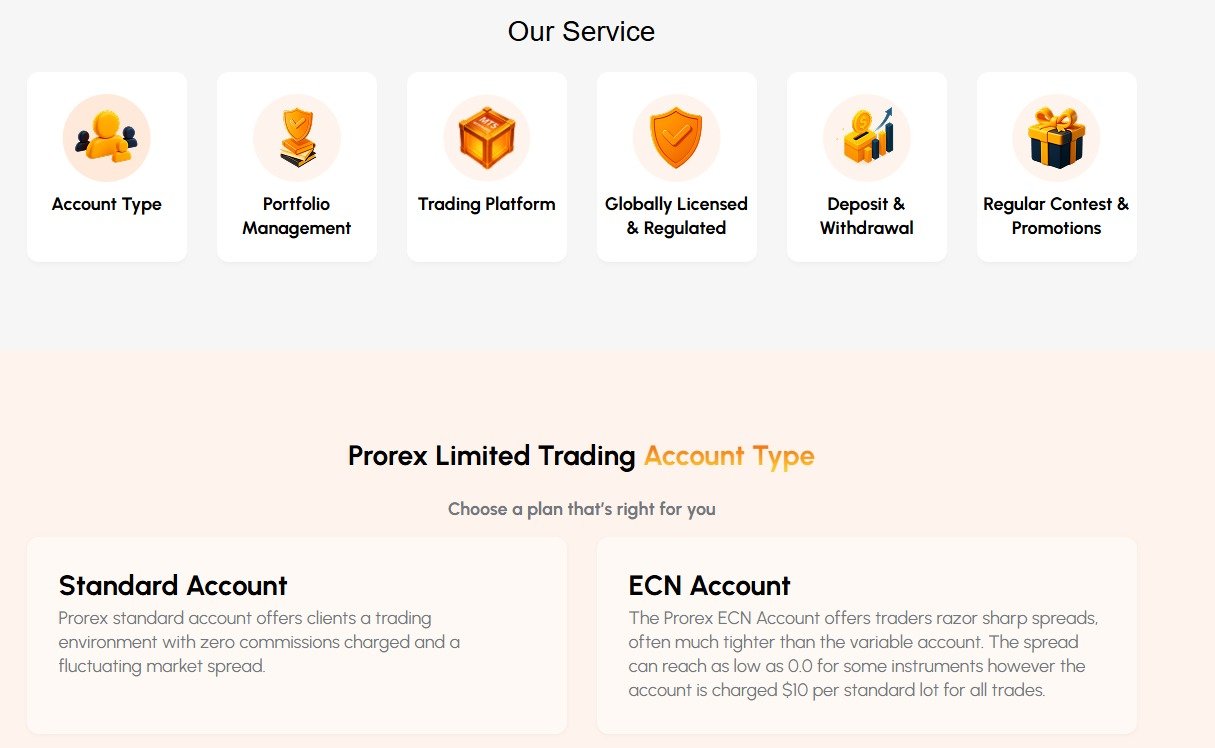

When you start a Prorex account types comparison, you’ll likely see the usual suspects: Standard, Pro, ECN. But what do these labels really mean for you? A Standard account is often the entry point, bundling costs into the spread for simplicity. This is a common setup for those just getting started with Prorex. For more active traders, perhaps those interested in a Prorex account for day trading, an ECN or Raw account might be more suitable and these typically offer tighter spreads but come with a fixed commission. It’s a different cost model entirely, one that can be more economical for high-volume trading and the choice here reflects your trading frequency. A key part of your Prorex investment strategy is deciding whether you prefer a single, predictable cost integrated into the spread or a more transparent, two-part fee structure.

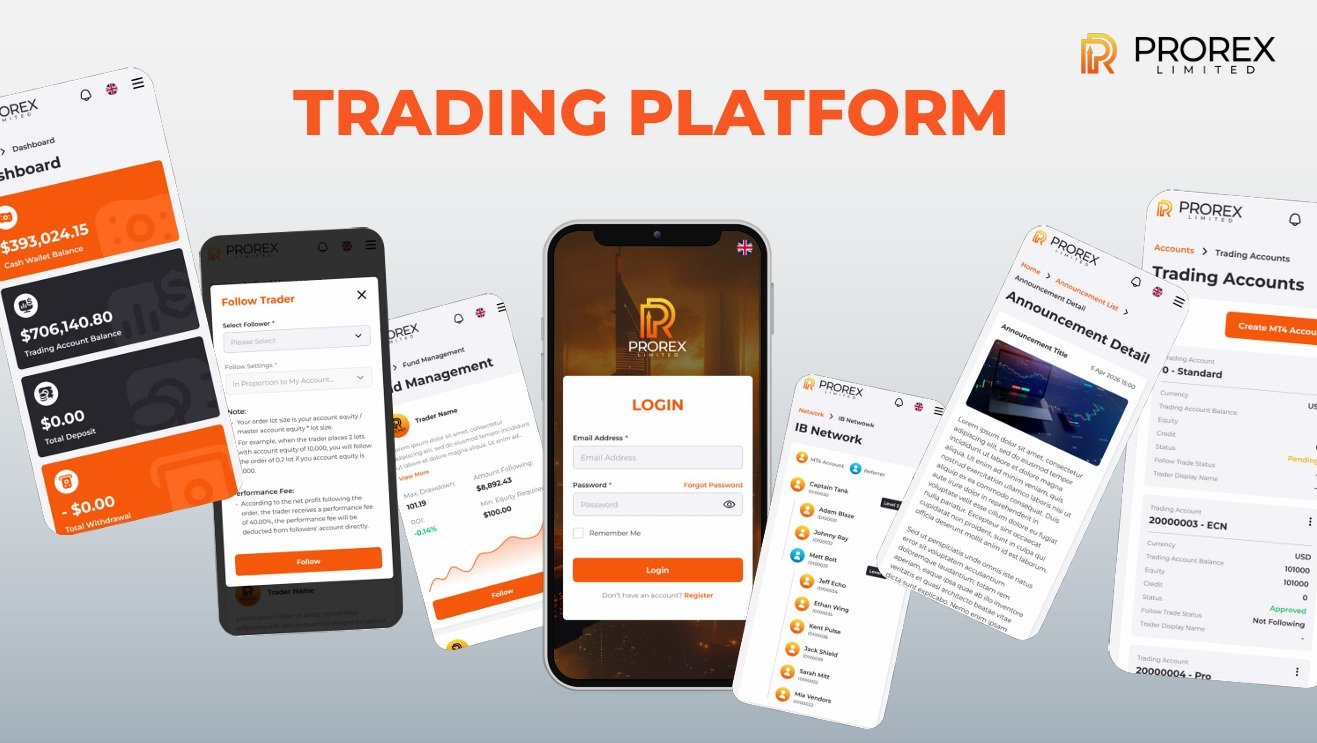

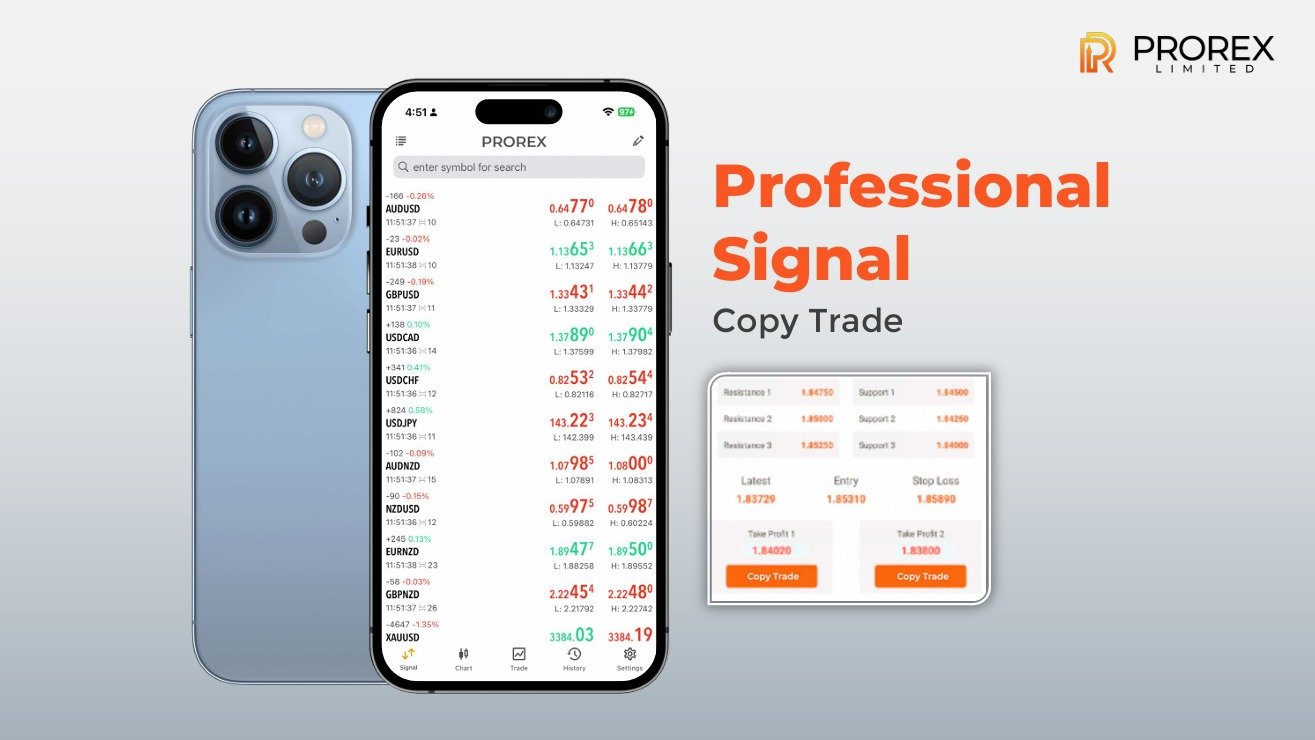

The Engine Room: A Look at the Prorex Trading Platform and Tools

An account is only as good as the platform it connects to. The Prorex trading platform is the cockpit from which you’ll navigate the markets and most brokers in this space offer access to widely-used platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), known for their robust charting tools and support for automated trading. Beyond the standard platform, it’s worth investigating the finer details. Does the broker offer any proprietary tools or plugins? What about the execution speed? For Prorex online trading, these factors are crucial. A clean interface and reliable execution can make a world of difference, especially in fast-moving markets.

Weighing the Incentives and Costs: The Prorex Trading Bonus and Fees

It’s easy to be drawn in by incentives, and a Prorex trading bonus can seem like an attractive offer. These often come in the form of deposit bonuses or rebates. While they can provide a boost to your initial capital, it’s critical to read the terms and conditions. Often, these bonuses are tied to specific trading volume requirements. On the other side of the coin are the Prorex trading fees. These go beyond just spreads and commissions and you should look into potential charges for deposits, withdrawals, and inactivity. A clear understanding of the complete fee schedule is essential for managing your long-term trading costs effectively.

Is Prorex a Good Broker for Beginners?

This is a question many newcomers ask. Answering it requires looking at a few key areas. First, does the broker provide educational resources? Access to webinars, articles, and tutorials can significantly shorten the learning curve. Second, is there a user-friendly demo account available? Practicing on a demo is a risk-free way to get familiar with the Prorex account interface and test strategies. Finally, how accessible is customer support? For someone new, knowing that help is readily available can provide crucial peace of mind. A broker that ticks these boxes is generally better positioned to support a beginner’s journey. The availability of accounts with low minimum deposits and flexible leverage, including a high leverage Prorex account, also plays a role, though caution is always advised with high leverage.

Making Your Decision with Clarity

Ultimately, selecting the right Prorex trading account comes down to a clear-eyed assessment of your own needs. It requires you to weigh the different account structures, test the trading platform, understand the full scope of fees, and see if the overall environment feels right for you. Whether you’re a beginner taking your first cautious steps or an experienced day trader looking for an efficient setup, the best choice is always one that is well-researched and aligns perfectly with your individual trading plan and risk tolerance.

Register PROREX member NOW! Click HERE

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia