The allure of a perfect signal—that definitive nudge to buy or sell at just the right moment—is as old as financial markets themselves. In today’s hyper-connected trading environment, this has evolved into a sophisticated industry of automated alerts and indicators. For many retail traders juggling market analysis with their daily lives, the concept is undeniably attractive. This brings us to the core of today’s discussion: the practical application and understanding of tools like Prorex trading signals, which aim to provide traders with timely market insights. But the real question isn’t just whether the signals exist, but how one can interpret and use them effectively within a personal trading framework.

Content

Decoding the Mechanics of Prorex Trading Signals

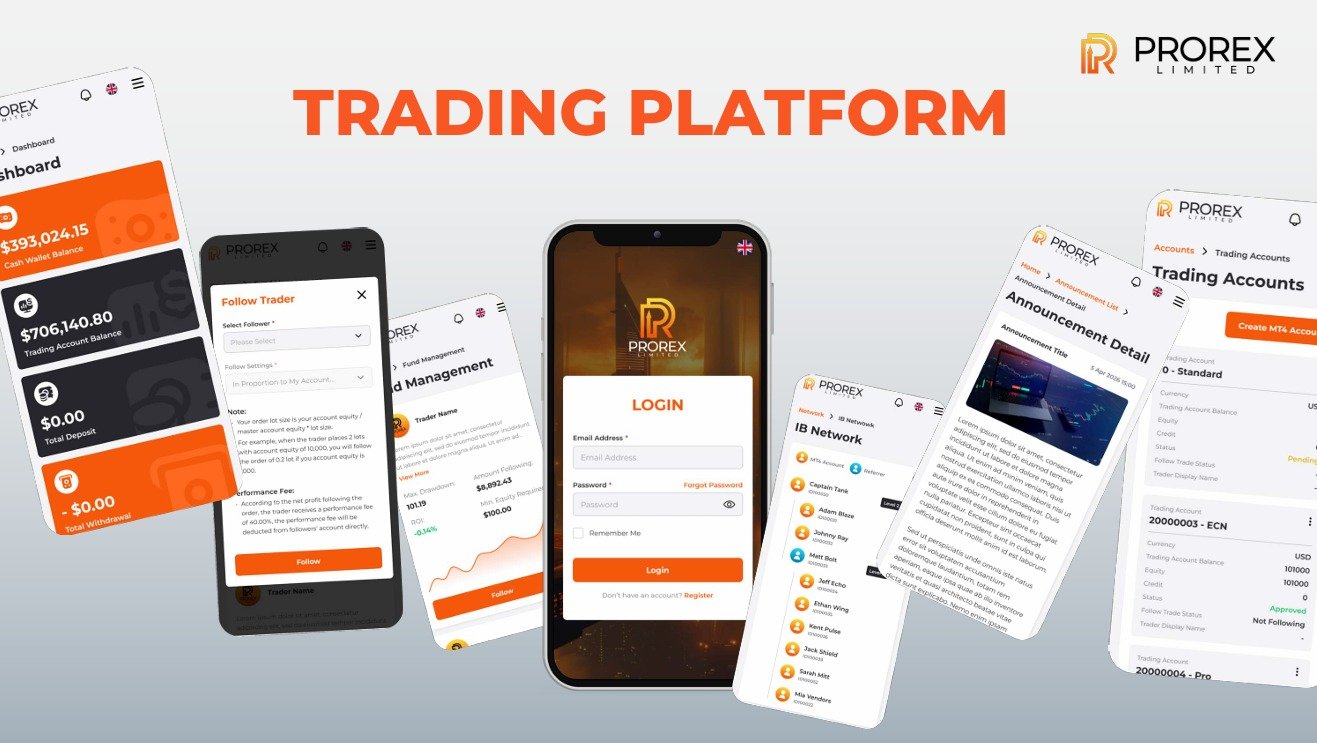

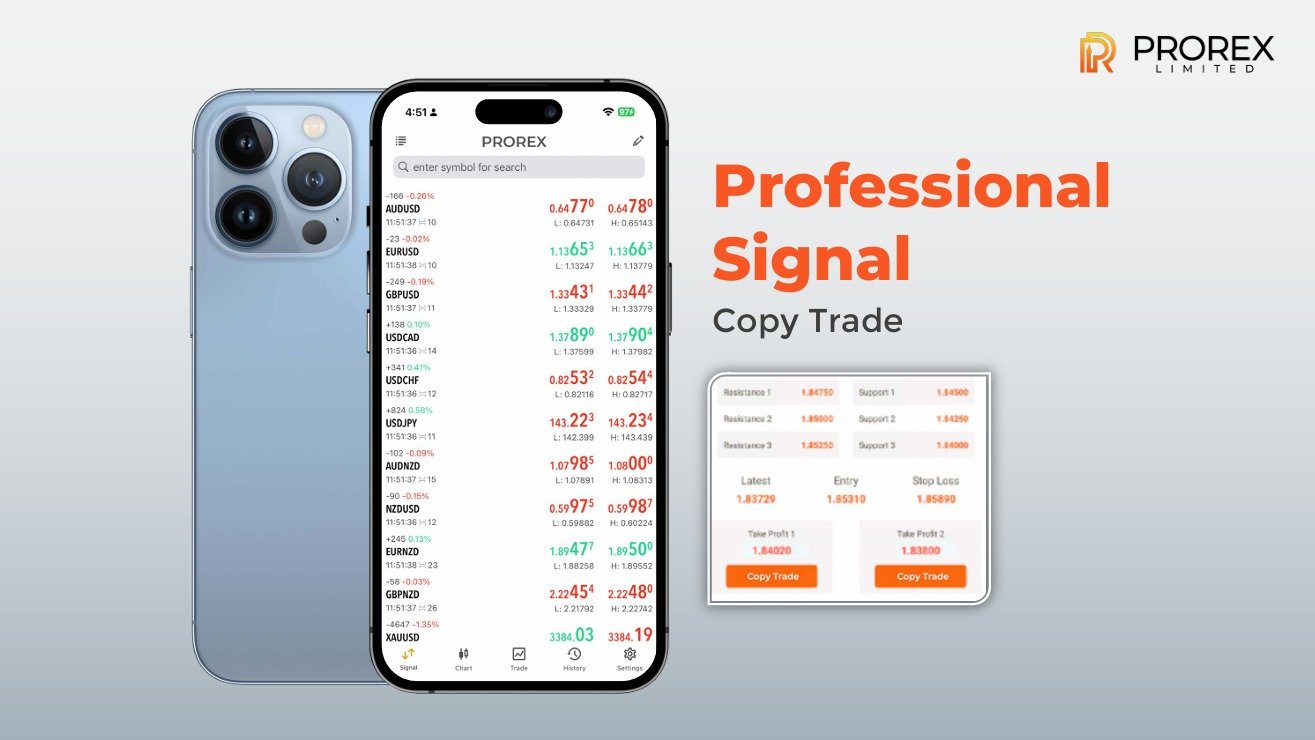

So, what exactly are we looking at when we talk about Prorex trading signals? From an analytical standpoint, these signals are essentially data-driven hypotheses. They are generated by algorithms that monitor market movements, price action, and a variety of technical indicators. The output is a clear, actionable suggestion—for instance, “Buy EUR/USD at 1.0850” or “Sell Gold at $2,350.” These are typically delivered directly through the Prorex trading platform, aiming for seamless integration so a trader can act quickly. The underlying logic, while proprietary, is generally rooted in established principles of technical analysis like moving averages, RSI, or MACD crossovers. The goal is to distill a huge amount of market data into a simple, digestible alert. However, it’s crucial for a trader to see these not as infallible commands, but as well-researched suggestions that should still be filtered through their own market perspective.

Beyond the Alert: Integrating Prorex Forex Signals into a Real Strategy

Receiving a signal is just the first step; the real skill lies in its integration. Blindly following any signal provider, whether it’s Prorex or another name in the market, is rarely a sustainable path for a serious Prorex investment strategy. An experienced trader uses signals as a confirmation tool or a point of interest for further investigation. Perhaps a signal confirms an analysis you’ve already conducted, giving you that extra bit of confidence to enter a trade. Or maybe a signal on a currency pair you weren’t watching brings a new opportunity to your attention. This is where personal discipline comes in. A signal doesn’t manage your risk for you. You still need to determine your own position sizing, set your stop-loss and take-profit levels, and understand how factors like the Prorex spread might affect the trade’s profitability. The signal is a piece of the puzzle, not the entire picture.

The Platform Ecosystem: Regulation, Accounts, and Other Considerations

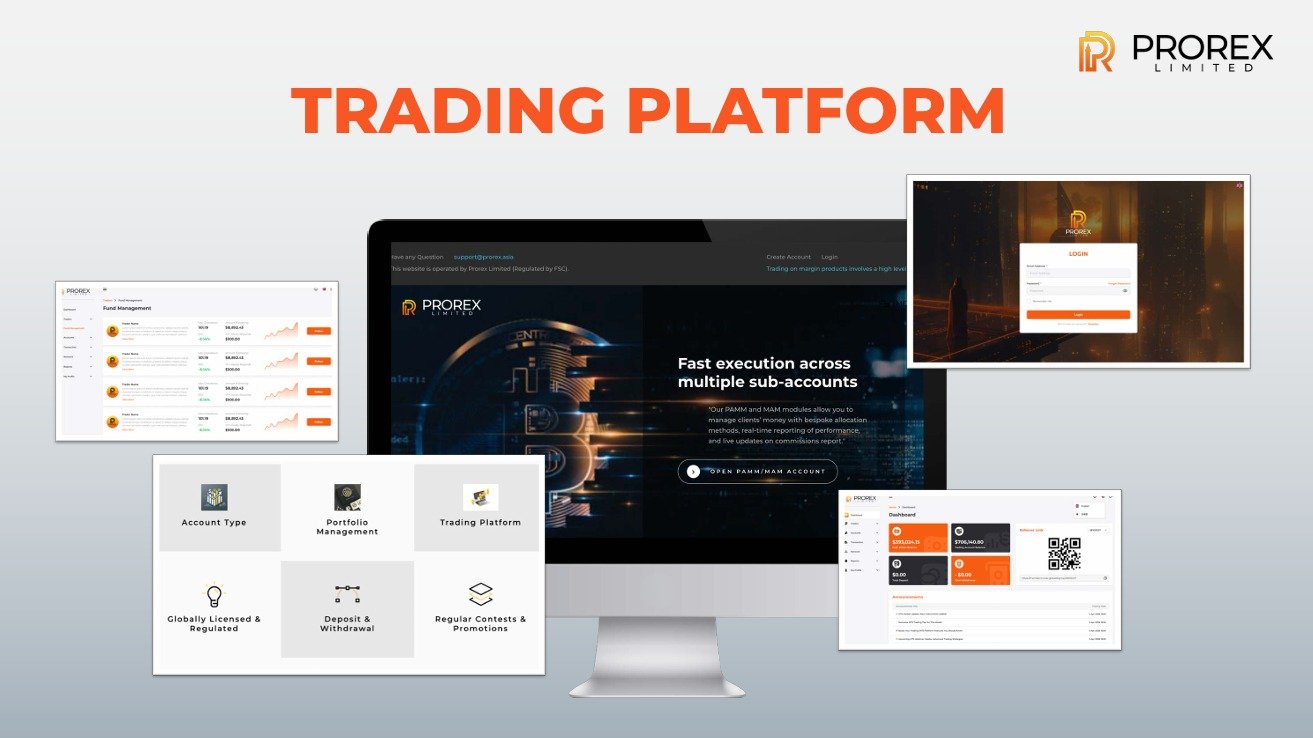

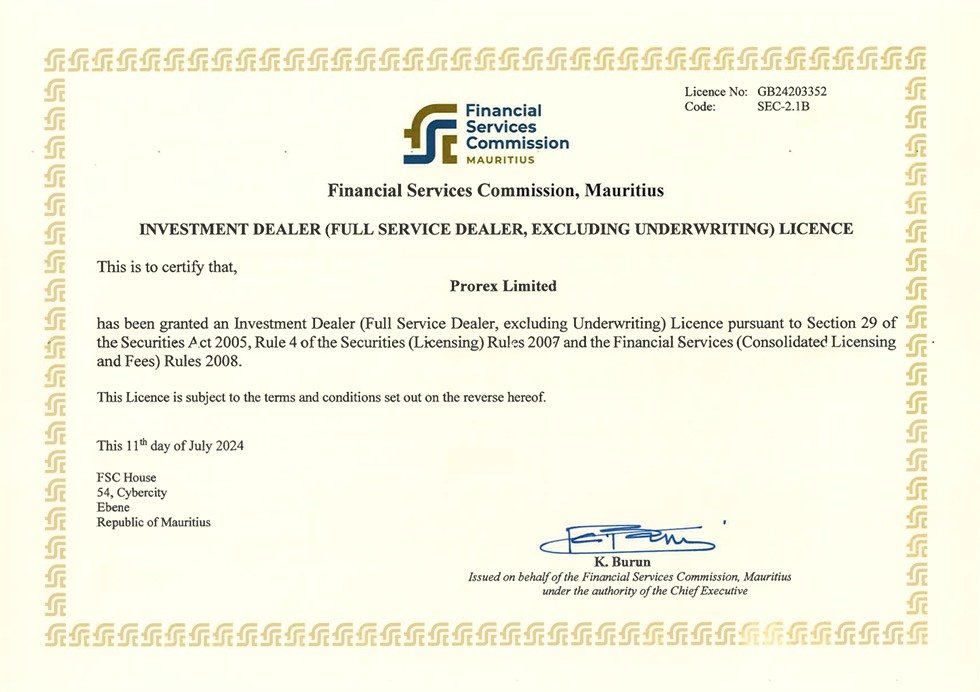

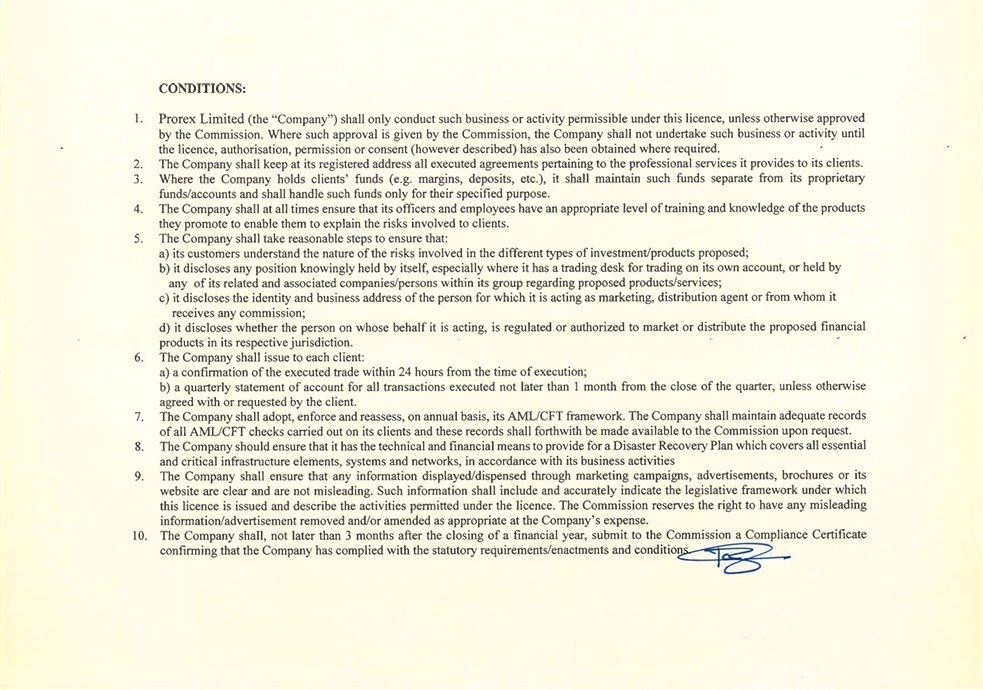

To effectively use a broker’s tools, you have to understand the environment they operate in. When evaluating the potential of Prorex trading signals, it’s prudent to look at the bigger picture. For instance, is the broker operating under a clear regulatory framework? The topic of Prorex regulation is a fundamental due diligence step for any trader, as it speaks to the security of your funds and the fairness of the trading environment.

Furthermore, the type of Prorex account you hold might influence your experience. Different accounts often come with varying spreads, commissions, or even access to premium features. Occasionally, a broker might offer a Prorex trading bonus as an incentive. But this should always be viewed as a secondary benefit, not the primary reason for choosing a platform. These elements—regulation, account structure, and spreads. Form the foundational context upon which the effectiveness of any trading tool, signals included, is built. As we head further into 2025, the conversation around the best forex signal providers is rightly shifting from just the quality of the signals to the overall integrity and structure of the platform providing them.

Conclusion

In conclusion, the conversation around Prorex trading signals is a nuanced one. They represent a sophisticated tool designed to simplify complex market data for the modern trader. When viewed and used correctly—as a component of a larger. Well-thought-out strategy that includes personal analysis and strict risk management—they can certainly be a valuable asset. The effectiveness doesn’t lie in the signal itself, but in the hands of the trader who wields it. Supported by a clear understanding of their trading platform and the broader market.

Register PROREX member NOW! Click HERE

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia