Step 1: Understand What a Currency Forecast Actually Tells You

The Rupiah Forecast 2025 is more than a number or headline — it’s an evolving interpretation of economic signals that affect the IDR’s value. Currency forecasts combine market sentiment, macroeconomic data, global conditions, and policy decisions into a directional view of where the Indonesian Rupiah may head. These forecasts are used by businesses, investors, and policymakers to prepare for risks and opportunities. But it’s important to treat them as a tool — not a prediction. Think of the forecast as a map: it doesn’t guarantee your destination, but it helps you navigate the road ahead with more confidence.

Step 2: Know the Global Forces Pressuring the Rupiah

Source: Coincodex

A major factor in any Rupiah forecast 2025 is what’s happening far beyond Indonesia’s borders. The most powerful influence often comes from the U.S. Federal Reserve. When U.S. interest rates stay high, investors are drawn to dollar-denominated assets, weakening demand for emerging market currencies like the IDR. In 2025, global uncertainty hasn’t gone away. Uneven recovery in China, energy price fluctuations, and persistent geopolitical tension have all contributed to cautious investment behavior. For the Rupiah, even indirect effects from these trends — like capital outflows or changes in trade demand — can lead to meaningful shifts in value over time.

Step 3: Analyze Indonesia’s Domestic Economy for IDR Clues

Source: Bloomberg

The IDR forecast also depends on Indonesia’s own economic story. At home, Bank Indonesia has kept a relatively stable hand, managing interest rates with a focus on controlling inflation. The government continues to prioritize infrastructure development and digital growth, which contributes to steady investor interest. Exports of commodities like palm oil and coal remain vital sources of foreign currency. But internal pressures exist too — including the potential for rising fuel subsidies, slower domestic consumption, or political transitions. All of these factors can influence investor confidence, which is closely tied to the health of the Rupiah in both the short and medium term.

Step 4: Follow Bank Indonesia’s Policy Signals

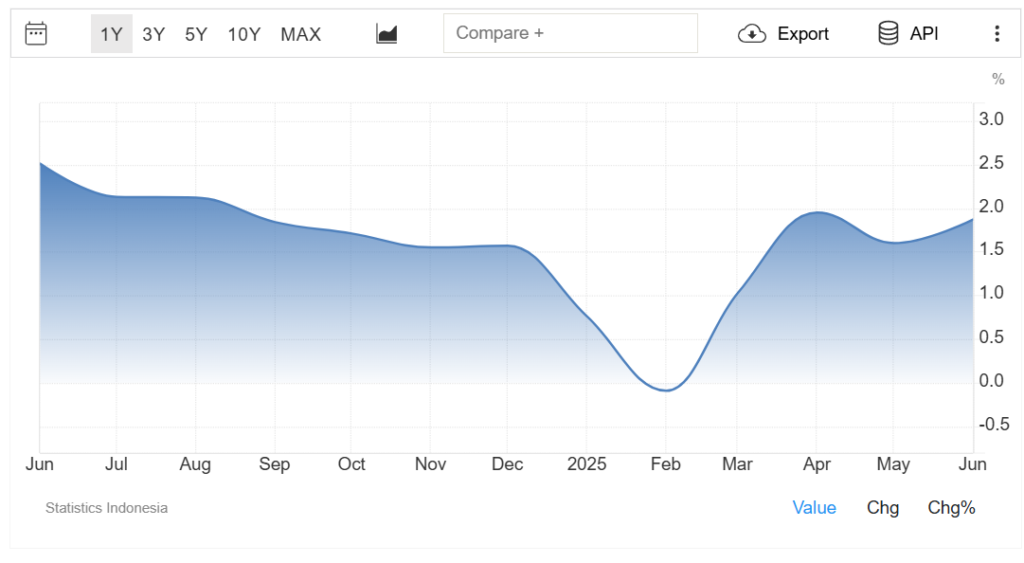

Source: TradingEconomics

Monetary policy remains central to the Rupiah forecast 2025, and Bank Indonesia continues to play a key stabilizing role. The bank has intervened in foreign exchange markets in the past to manage volatility and smooth out abrupt IDR movements. In 2025, observers are watching closely to see how it balances between inflation control and support for economic growth. If inflation stays within target, the central bank may maintain its current stance — but if pressure builds, it may shift policy to protect the currency. Decisions on interest rates, liquidity measures, and even communication tone all send signals that markets react to quickly.

Step 5: Rupiah Forecast 2025- Monitor Commodity Prices and Trade Trends

Indonesia is deeply tied to its commodity exports, so the Rupiah forecast cannot ignore trade dynamics. The country’s trade surplus, powered by coal, nickel, rubber, and palm oil, provides essential foreign exchange earnings. However, if global demand for these goods weakens — or prices fall — that surplus could shrink, weighing on the IDR. Additionally, higher global oil prices could increase import costs and fuel inflation domestically, putting additional pressure on the currency. The strength or fragility of Indonesia’s trade performance in 2025 will likely remain one of the most visible signals in the Rupiah’s path.

Step 6: Rupiah Forecast 2025- Compare the Rupiah to Other Emerging Market Currencies

In the emerging market currencies outlook 2025, the Indonesian Rupiah sits in a relatively stable position — but it’s not immune to group sentiment. When global investors turn away from emerging markets in general, the IDR often gets swept up with peers like the Thai baht or Philippine peso. Even if Indonesia’s fundamentals are stronger, the Rupiah may still face short-term weakness during broad sell-offs. That’s why it’s important to compare movements across the region and globally, to see whether shifts in the Rupiah are part of a larger trend or uniquely domestic in nature.

Step 7: Rupiah Forecast 2025- Apply the Forecast to Your Financial or Business Plans

Once you understand the elements behind the Rupiah forecast 2025, the next step is knowing how to use it. Businesses can prepare for exchange rate shifts by budgeting conservatively, locking in rates where needed, or diversifying suppliers. Investors might assess the risk and return of holding IDR-denominated assets versus alternatives. Meanwhile, consumers planning overseas purchases or travel can benefit from monitoring the currency’s movements throughout the year. Whatever the application, the key is flexibility — using the forecast not as a fixed rule, but as a reference point for better planning and smarter decision-making.